- Summary:

- The Unifi Protocol DAO price predictions indicates that there is a high potential for prices to drop even further.

The Unifi Protocol DAO price predictions are decidedly bearish, with two days to go before the Fed Reserve has to make a monumental decision on the US interest rates going forward. In anticipation of a significant hawkish move, the crypto market has seen billions of dollars in historic outflows. Monday has turned out to be a ruthless day, with Bitcoin now dancing around the 23,500 mark, losing nearly 25% of its 9 June value. This scenario has seen Unifi Protocol DAO and almost every altcoin seeing red on the day.

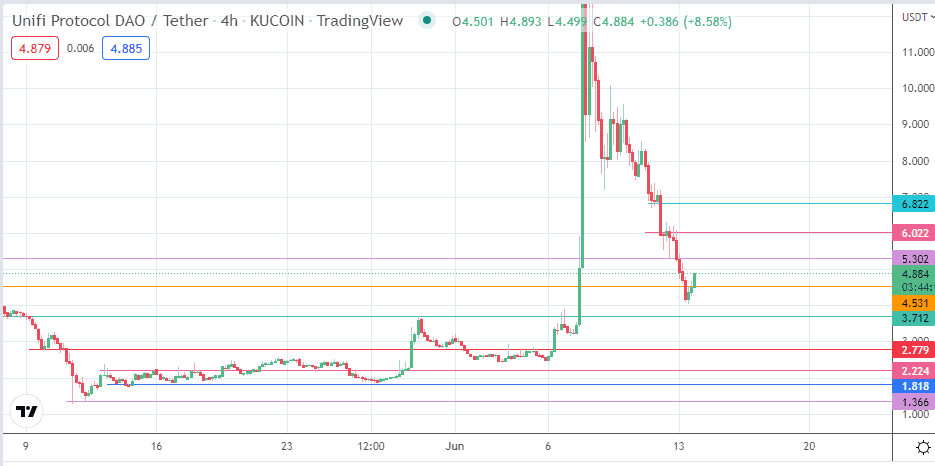

The 7 June spike saw Unifi Protocol DAO spike 700% in four hours. But many traders were caught on the wrong side of the move. The retracement that followed not only erased all the gains of that period but sent the token even lower. The retracement shattered the support at 5.302 and the 4.531 pivot as well. However, some profit-taking by short sellers has allowed for a brief rally, which will only produce a new selling opportunity with the current market sentiment.

With US inflation soaring to 41-year highs, the Fed is now under pressure to do something about the situation quickly. A 50bps rate hike is the market consensus. But if the Fed goes beyond this to deliver a 75bps or even a 100bps rate hike, this will send the bearish Unifi Protocol DAO price predictions into the stratosphere.

Unifi Protocol DAO Price Prediction

The breakdown of the 4.531 support has occurred, with confirmation provided by the price filter (3% penetration close below this support) on Saturday, 11 June. The price action has made a return move to test this price mark. A rejection at this point allows the bears to resume the downtrend, targeting 3.712 initially (8 May 2022 low and 30 May 2022 high). Below this level, additional downside targets are seen at 2.779 and 2.224 (24 May 2022 low). The 12 May 2022 low may also come into the picture if there is heavy price deterioration, but not before the 1.818 support level that comes before it has given way.

On the flip side, a break of 4.531 allows for a recovery toward 5.302. 6.022 and 6.822 are the other resistance levels above 5.302. It is hard to see prices recover beyond these levels in the current environment. Any rallies remain short-selling opportunities

Unifi Protocol DAO: 4-hour Chart