- The Twitter share price could face another bearish run as the fake bot saga poses a new threat to Musk's acquisition.

The Twitter share price has opened slightly higher this Tuesday, a day after falling more than 1.4%, as the acquisition process continues to hit stumbling blocks. The slump in the Twitter share price on Monday followed the announcement of a probe by the Texas Attorney-General’s Office into fake bot accounts on the social media platform.

The investigation aims to determine if the social media giant presented false statements in reports filed over fake bot accounts, which would violate the Texas Deceptive Trade Practices Act. Twitter had claimed that less than 5% of its users are bots, but there are claims that the numbers could be at least four times higher.

In addition, Attorney General Ken Paxton says that Texan businesses and advertisers who rely on Twitter for their livelihoods do so based on nearly all Twitter users being real people. Tesla CEO Elon Musk, who launched the $44 billion acquisition, has threatened to pull out of the deal if the platform cannot provide accurate data on how many such bot accounts are operational.

This leads many to question if Musk now has the “buyer’s remorse”, considering the urgent manner in which he pushed the deal without a full-scale due diligence check on the company. Musk had offered to pay $54.20 for the stock, but the Twitter share price currently trades below $40.

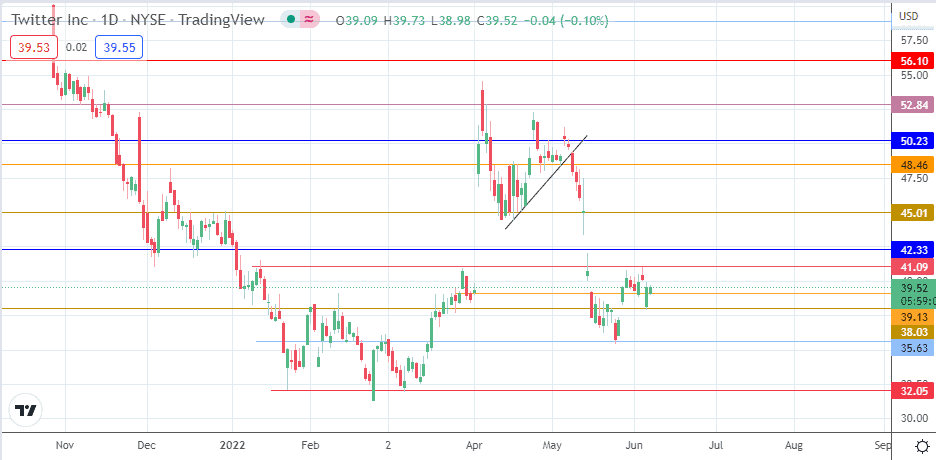

Ever since the Twitter share price broke below the ascending trendline on the daily chart on 9 May, it has declined steeply, and recovery efforts have been unable to take the stock above the $42 mark. So what is the Twitter share price outlook given the current situation?

Twitter Share Price Forecast

The immediate resistance lies at the 41.09 price mark (29 March and 3 June highs). A break of this barrier opens the gates for the bulls to march towards 42.33. A continued advance to 45.01 (30 December 2021 high and 19 April 2022 low) closes the 13 May downside gap.

Conversely, a breakdown of the 39.13 support (1 April low) opens the gates toward 38.03. Below this support, additional targets to the south lie at 35.63 (16 February and 24 May lows) and at 32.05 (8 March low).

Twitter: Daily Chart