- Summary:

- A positive surprise for the Turkish economy came from the Trade Balance figures that increased from previous -2.98 billion to -1.84 billion for May

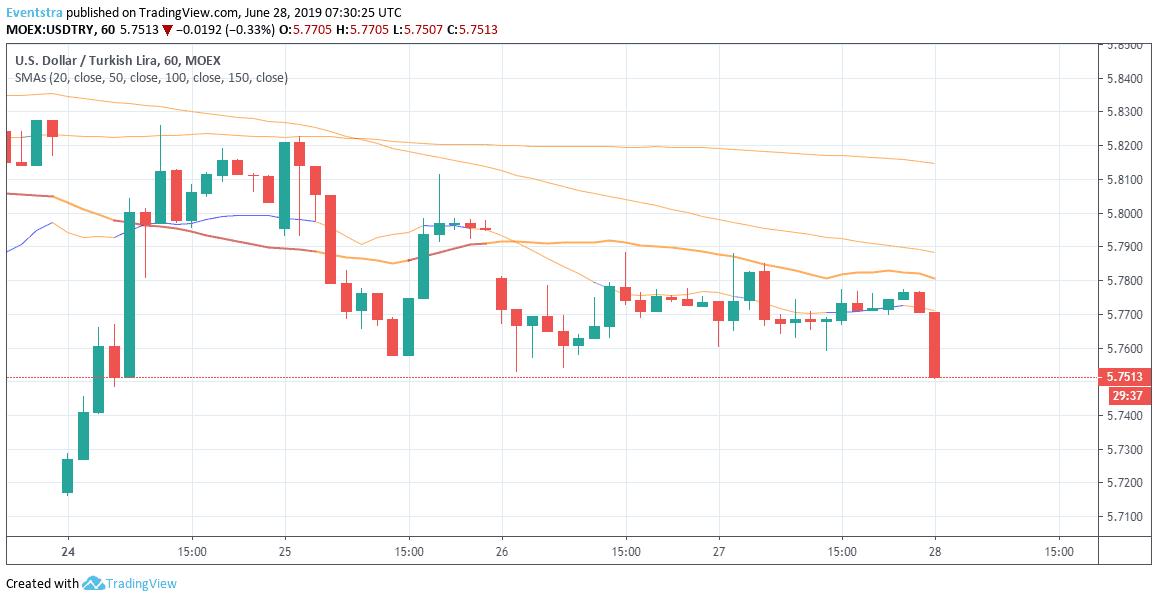

A positive surprise for the Turkish economy came from the Trade Balance figures that increased from previous -2.98 billion to -1.84 billion for May. USDTRY reacted immediately and pushed to daily low at 5.7596. Macro data from USA yesterday failed to attract USD investors as the GDP revision for the first quarter expanded by 3.1 percent in a Year on Year basis, to match previous estimate and the economist’s estimates. The Personal Consumption Expenditures Prices reported at 0.5% on a quarterly basis for first quarter better than analysts’ forecast. The initial Jobless Claims came in at 227,000 beating analyst’s estimates of 220,000 for June 21. Turkey’s Central bank kept the one-week repo rate at 24% earlier this month and I expect the CBRT to continue to support the current tight monetary conditions. Imamoglou victory in the Istanbul mayoral election also helped the Turkish Lira. Turkish economy facing numerous problems from US threats for sanctions because of the Russian S400 defense system, to tensions in the Aegean and the Mediterranean Sea with Greece and Cyprus as drilling in the area continues by the biggest oil companies.

On the technical side the pair will find support at 5.6880 the 100 day moving average while more bids will emerge at 5.5658 where the 150 day crosses. On the upside first resistance stands at 5.9180 the 50 day moving average, then at 6.00, the high from May 30, while more resistance will be met at 6.19 the high from May 8th.

Don’t miss a beat! Follow us on Twitter.