- Summary:

- Central Bank of the Republic of Turkey announces measures to force lenders to make credit available to local business in order to boost the Turkish economy.

The Turkish Central Bank has announced measures to boost lending in the Turkish economy, effectively joining the league of central banks across the world which have either implemented new stimulus packages or are mulling doing same. According to a press release which was put out by the Central Bank of the Republic of Turkey (CBRT) yesterday, new measures to encourage bank lending are to be rolled out.

One of the measures to be implemented is a change to the reserve requirement ratios (RRR). RRR for Turkish lira liabilities and the rates of remuneration for required reserves which are denominated in the local currency are to be linked to the annual growth rates of the total amount of cash loans to be provided by banks in the local currency. Foreign currency loans are excluded from this arrangement.

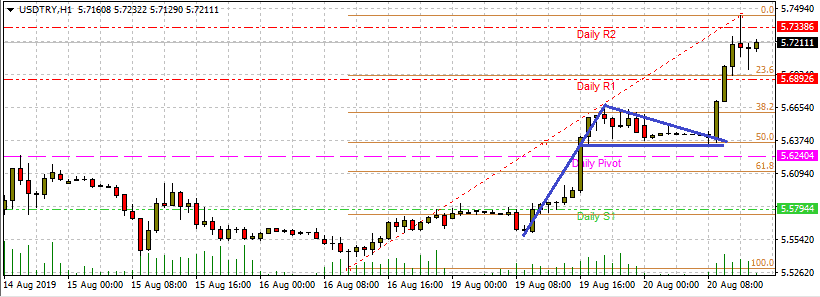

The Turkish Lira fell 1.4% on this announcement on Monday and is currently trading at 5.72121. The USDTRY has found resistance at the R2 pivot, after breaking out of the near term bullish pennant pattern.

The Fibonacci retracement trace from the swing low of August 16 to today’s swing high shows that the R1, central pivot, correspond to the 23.6% and 50% Fibonacci retracement levels, with the upper border of the pennant aligning with the 38.2% Fibonacci retracement levels. Dip buying at any of these price levels where price finds support would be a logical way to go. A breakdown at any of these levels would validate the support level below.