- Summary:

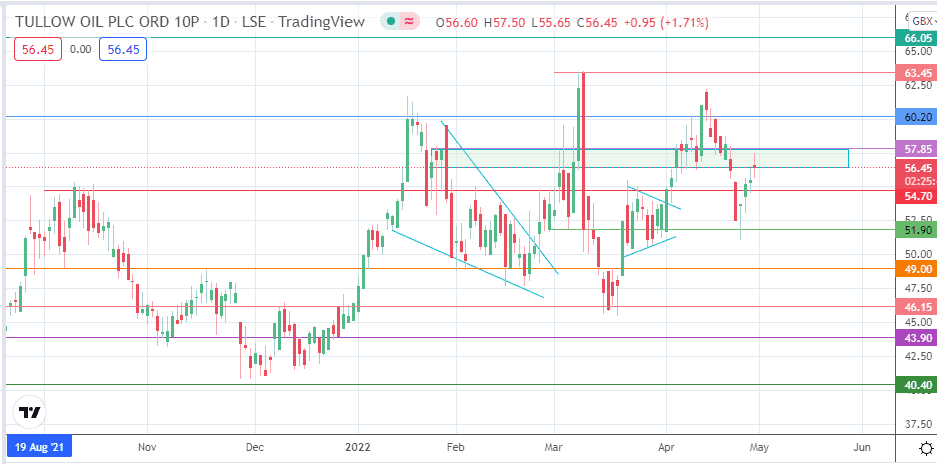

- The Tullow share price has to overcome a key resistance zone between 56.45 and 57.85 before the 60.20p target can be attained.

The Tullow share price is trading 1.98% higher and looks good to end the week on a higher note as rising crude oil prices put some tailwinds on the stocks of energy companies. However, the price action for Friday has been choppy and currently forms a doji as the bulls and bears battle for supremacy on the day.

The limitation in the upside move on Friday is a direct consequence of the neutralising impact of the rising potential for an embargo on Russian oil on the one hand and the reduced demand from China due to lockdowns in Shanghai and other major cities. Demand from China is down 1 million barrels per day. This demand drop-off from the world’s largest crude oil importer has put a lid on the rise of oil stocks even as Germany indicates its willingness to drop its opposition to any EU moves to block Russian oil imports.

The Tullow share price is also getting some tailwind from projections of increased yields from its new Jubilee and TEN oil fields in Ghana. Eight analysts on Wall Street have set a 12-year target of 69.85p for the Tullow share price. This gives an upside potential of roughly 25%, even as it is currently up by 0.44% for the week.

Tullow Share Price Outlook

The active daily candle challenges the resistance zone at the 56.35/57.85 price area. The bulls need to surmount this resistance area to gather momentum that takes the price activity towards the 60.20 resistance target (20 January/8 April highs). Above this level, 63.45 (9 March high) and 66.05 (16 June 2021 high) are additional targets to the north.

On the flip side, a rejection at the resistance zone opens the door for the bears to force price action towards the 54.70 support (28 April low). Below this area, a decline brings 51.90 into the picture, having served as the site of previous lows of 4 March and 1 April 2022. Finally, 49.00 (3/16 February lows) and 46.15 round off the potential targets to the south in the short term.

Tullow: Daily Chart

Follow Eno on Twitter.