- The TUI AG share price is down by 2 per cent in today’s trading session, continuing a strong bearish trend that has persisted for two weeks

The TUI AG share price is down by 2 per cent in today’s trading session, continuing a strong bearish trend that has persisted for the past two weeks. Before yesterday’s price gain of 2 per cent, the company had been on a five consecutive bullish streak.

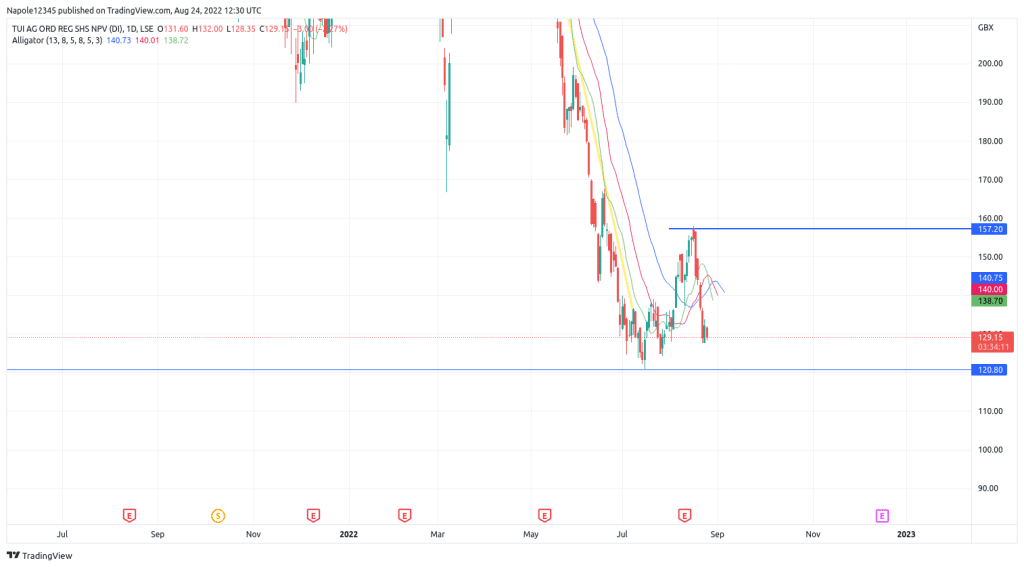

Despite the drop, Deutsche is still aggressively bullish on the company. In its latest ratings, Deutsche indicated they had a target price of 156p for the share price. This is 18 per cent from the current price of 129p price level that the company is trading.

In a report released a week ago, TUI AG was found to have made a comeback, with its services almost returning to pre-pandemic levels. However, the company’s financial report for quarter 3 indicated that, despite the efforts and work geared towards profitability, the company still finished with a loss. Part of the reason for this was due to the ongoing flight disruptions and cancellations that have affected the tourism industry, including TUI AG.

According to rough estimates, the flight disruptions had cost TUI Group a whopping €75 million ($76.5 m) in its third quarter. Without the disruptions, the company would have entered into profitability. However, the financial reports released showed the company ended up with a loss of €27 million ($27.5 million).

TUI AG Share Price Analysis

As seen above, part of the reason why the company has continued to perform badly is due to fundamental factors such as flight disruptions. Today, these problems are still posing a problem to the company and remain unaddressed.

Therefore, despite the company receiving a bullish rating from financial institutions such as Deutsche, my price prediction for TUI AG share price remains to the downside. In the next few trading sessions, I expect the prices to continue falling, with a likely price level of 120 being hit. There is also a high likelihood that we might see TUI AG share price trading below the demand level, and if past price action is anything to go by, prices may go as low as the 100p price level. My analysis will be invalidated should the share trade above the 140p price level.

TUI AG Daily Chart