- The latest loss puts the TUI AG share price on course to retest the all-time lows of 2020 if the bulls do not protect the current support.

The TUI AG share price could not sustain the gains of 2 September 2022 after losing its initial uptick of the day. It now trades 5.37% lower and could reach its 2020 trough if the travel group’s stock breaches the 15 July low.

The TUI AG share price drop comes as the company’s pilots launch a lawsuit against it over changes made to pension benefits and sick pay. A new sick pay plan was approved by staff a year ago, but several pilots have filed a lawsuit claiming that the documentation hid the true nature of the changes. Some pilots say they have lost nearly 50% of their salaries to the altered system. Other changes, the pilots said, are the removal of a 5% pay increase and several changes to the pension system.

TUI AG says the changes followed consultations with the union and that it was disappointed with the claims made by the pilots. A spokesman declined further comments, citing the ongoing lawsuit as an impediment.

The TUI AG share price has been in free fall after the summer travel chaos led to the cancellation of more than 200 flights. The company said it lost 63 million pounds in revenue due to the chaos, and it posted a pre-tax loss of 23 million pounds in the April-June quarter of 2022.

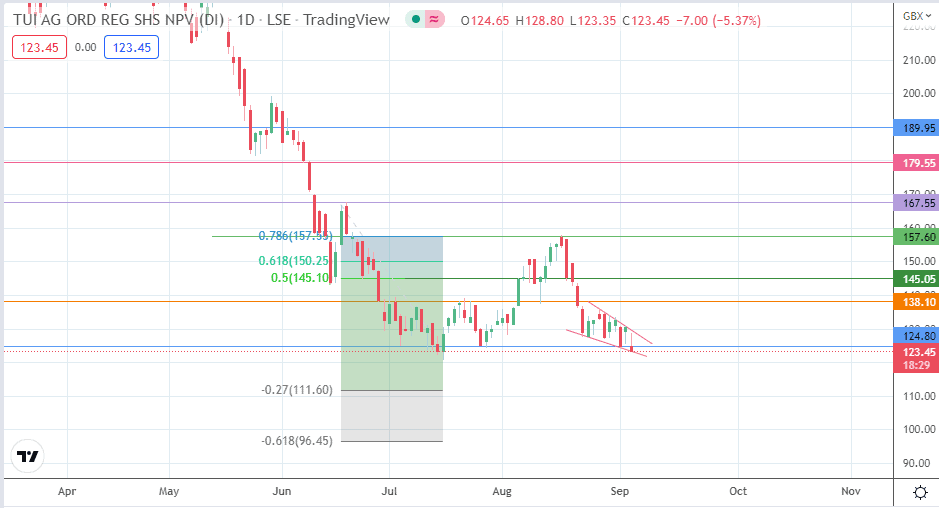

TUI AG Share Price Forecast

The active daily candle is testing the support formed by the 124.80 price mark (5 July and 27 July lows) and the lower edge of the falling wedge pattern. A bounce on this support that takes the price action above the 130.00 psychological price mark/upper wedge border completes the pattern and forces a measured move toward 138.10 (29 June and 10 August lows).

Above this level, the 50% Fibonacci retracement level at 145.10 (24 June and 5 August lows) forms the next upside target. Above this level, potential harvest points for the bulls are also seen at the 150.00 psychological resistance, 157.60 (78.6% Fibonacci retracement level and 16 August high) and 167.55 (21 June high).

However, this outlook is negated if the price action breaks below 124.80. This would open the door toward the 16 March 2020 all-time low at 112.60. A breakdown of this low sends the TUI share price to new record lows, with 111.60 (27% Fibonacci extension) and 96.45 (61.8% Fibonacci extension) forming the immediate targets to the south.

TUI AG: Daily Chart