- Summary:

- TSCM share price hit record highs past the $200 mark on Thursday as the company reported a net profit of $10.1 billion in Q3 financials.

Taiwan Semiconductor Manufacturing Company (NYSE: TSM) share price spiked in Thurday’s pre-market trading session, propelled by news of forecast-beating Third Quarter earnings and upbeat guidance for the current quarter. TSCM set a record high price above the $200 mark in the pre-market session and was up by 7 percent at the time of writing.

TSMC, the world’s largest contracted manufacturer of semiconductor chips reported a profit of $10.2 billion, up by 54 percent year-over-year. In addition, it reported revenues of $23.5 billion and beat median EPS forecasts by $0.15.

The Taipei-based company expects its Fourth Quarter revenues to rise by about 13 percent quarter-over-quarter to between $26.7 billion and $26.9 billion. Furthermore, the company has revised its Full Year earnings growth forecast to 30 percent from the previous 24 percent-26 percent range.

The company has a strong customer base, among them leading smartphone manufacturer Samsung and Nvidia, whose forays in the AI chipmaking have seen phenomenol growth. It attributed its strong show to a high demand from the AI segment and smartphone market.

The strong performance by TSMC contrasts with Dutch semiconductor company, ASML Holding, which posted weak earnings results on Tuesday and gave a weak outlook for 2025. Meanwhile, TSMC share price has risen by 83 percent year-to-date, and could hit the tripple-digit mark when markets open.

TSMC share price prediction

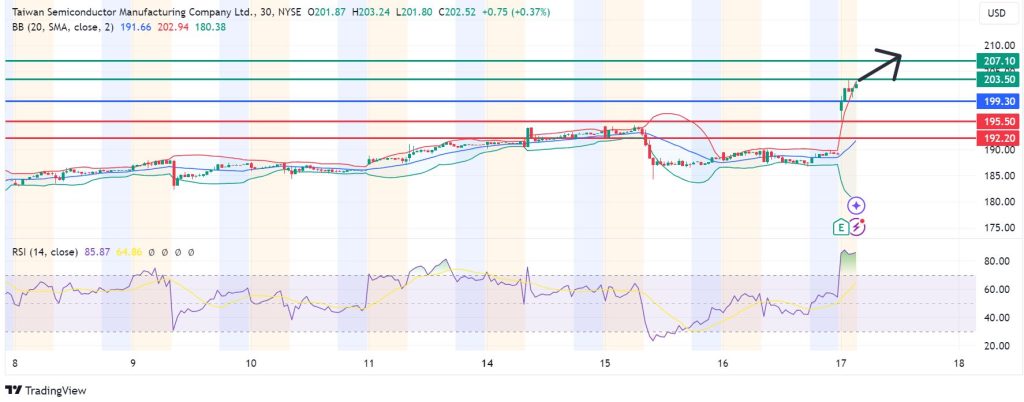

The momentum on TSMC share price signals strong bullishness and calls for a continuation of the upside above $199.30. With the buyers in control, the upward momentum could encounter the first resistance at $203.50. However, if the bulls extend their control, the stock could break above the resistance to test $207.10.

Conversely, moving below $199.30 will signal a bearish teakeover. In that case, the first support will likely come at $195.50. However, a stronger downside momentum could break below that level to invalidate the upside narrative and potentially test $192.20.