- Summary:

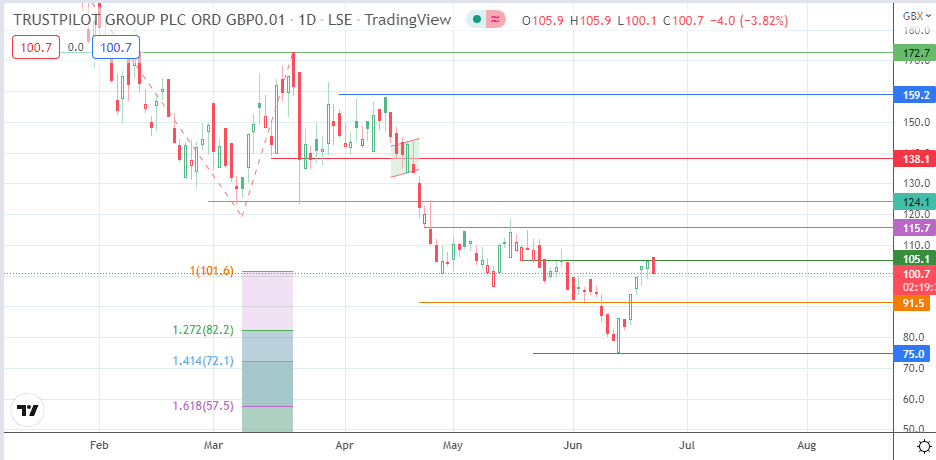

- The Trustpilot share price could be set for a run to the south if the bearish engulfing candlestick is confirmed at the 105.1 resistance.

The Trustpilot share price looks set to end Thursday’s trading session on a lower note after investors failed to extend the 4-day winning streak by another day. There were already signs that the bears could come into the picture, as the previous two daily candles revealed some early selling pressure before the bulls managed to make it over the finish line on top.

The Trustpilot share price has spent most of 2022 under selling pressure. Revenue growth forecasts of 29% in January and a 24% subsequent rise in revenue for the 2021 fiscal year have given way to a more pessimistic outlook for the stock after the company still ended up with more than double its 2020 loss for FY2021. This was primarily due to costs associated with its initial public offer (IPO).

The company is also preparing for a change of leadership. Outgoing Chairman Tim Weller, who has held the reigns at the company for ten years, is set to leave the company, a situation that has irked a segment of shareholders.

As identified by several institutional analysts, the average target for the Trustpilot share price is 184p. Though this indicates upside potential, it is hard to see the stock getting this far at the moment. As a result, short-term plays would favour selling on rallies until the price clears the 159p mark.

Trustpilot Share Price Forecast

If the daily candle closes at or below the current price, it will form a bearish engulfing pattern, triggering the potential for a more significant selloff from the 105.1 resistance. This makes the 91.5 support level the next target for the bears. A breakdown of this level, where the 7 June low lies, opens the door for the price activity to aim for 80.0 (13 June low). The 15 June 2022 low at 75.0 will become an additional harvest point for the bears if the bulls fail to defend the 91.5 support.

On the other hand, the bearish view becomes invalid if the bulls can push the price beyond the 105.1 resistance. This clears the pathway to 115.7. Above this barrier, the 124.1 price mark (22 March low and 26 April 2022 high) presents as the next upside target. A further advance makes a case for the 138.1 resistance to become a new target to the north, but 130.00 (9 March low and 22 April high) may serve as an intervening pitstop.

TRST: Daily Chart