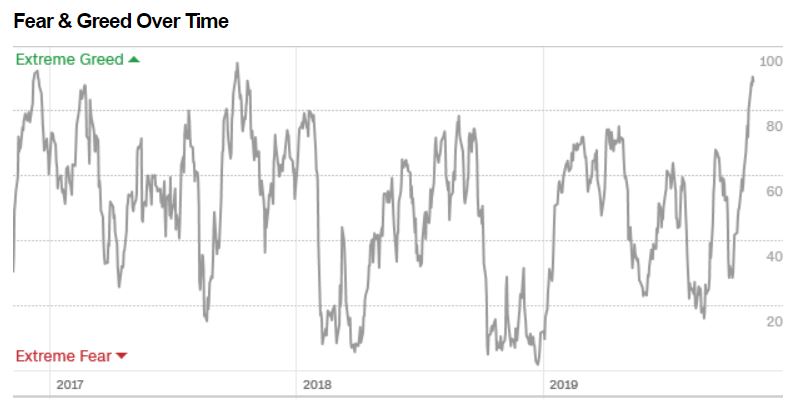

Fear and Greed Index

On this page, you will find our latest updates on the CNN Fear and Greed Index.

The CNN Fear and Greed Index in its purest form answers the question, “What is the predominant emotion of the stock market right now?”

It’s a sentiment indicator that tells if equities are undervalued or overvalued. The logic behind it is that too much greed can push stock prices beyond their fair price, while too much fear can cause stocks to slip well below their intrinsic price, as traders don’t act rationally in the short-term.

The Fear and Greed index uses seven indicators to conclude the extent of the market’s fear and greed and measures the market’s sentiment based on these two emotions on a daily, weekly, monthly, and annual basis. The following metrics compose the index and aim to provide a holistic view of the market’s emotions:

- Put and Call Options: How much have put options lagged behind call options?

- Market Momentum: Where is the S&P 500 relative to its 125-day average?

- Stock Price Strength: It counts the number of stocks that have touched 52-week highs vs. 52-week lows on the New York Stock Exchange (NYSE).

- Stock Price Breadth: The McClellan Volume Summation Index compares the volumes on rising stocks versus declining ones.

- Safe Haven Demand: How well are stocks performing compared to safe-haven assets like US Treasury bonds?

- Market Volatility: It uses the Chicago Board Options Exchange Volatility Index (VIX) relative to its 50-moving average.

- Junk Bond Demand: What is the spread between junk bonds and safer, investment-grade corporate bonds?

How to use the Fear and Greed Index?

The seven metrics are individually-measured on a scale of 0-100 with lower numbers indicating fear while higher figures pointing to greed. They are then weighted equally to calculate the Fear and Greed Index.

The index is a great tool to help investors and traders get an idea of when it is time to enter the markets. When the Fear and Greed index is trading near its recent extreme lows it hints that a significant bottom in the market is pending. The index should be interpreted with the help of technical analysis to improve entry signals. It is also possible to use the index to figure out when the market is overbought, but at least historically, the indicator is less useful to predict significant highs.