- Summary:

- The stock market has hit bumps this week with key indices down. However, Disney, Verizon and Home Depot stock prices are among top stocks.

Table of Contents

US equities markets are strained, as investors assess the macroeconomic environment against the recent earnings releases and the implications of the forthcoming US elections. The mood has been largely sour this week, with the Dow Jones Industrial Average Index on course to register its third successive daily decline as of this writing. However, amidst this, Verizon, Home Depot and Disney stock prices signal resilience which could keep them up.

Verizon

Verizon stock price was up by 2.2 percent at the opening of Thursday’s trading session, and its fundamentals support further gains. The company announced its quarterly earnings on Tuesday, with reported revenues of $33.30 billion and an EPS of $1.19. The revenue was equivalent to a growth of 0.9 percent over the corresponding quarter last year.

The company signed a $100 million deal with AST Spacemobile in May, aiming to leverage the benefits of direct mobile-to-device connectivity, which will include reduced redundancy and 100% coverage of continental USA. That also enables it to go head-to-head against AT&T on that front.

As per the quarterly results, Verizon (NYSE: VZ) performed impressively in all key fronts. Its adjusted EBITDA margin grew by 1 percent to 37.5 percent YoY and reduced its debt from $175.8 billion to $169.2 billion quarter-on-quarter. It also grew its postpaid customer base significantly, with retail customers going up by 81k and enterprise customers rising by 158k. Therefore, the post-earnings stock price decline was likely a result of profit-taking and not a reflection of the company’s bottom-line and growth outlook.

Verizon stock price prediction

Pivot: The stock is likely to pivot at 42.30. Action above this level will signal control by the bulls. A move below it will favour the downside momentum.

Support: Initial support is likely to come at 42.00. Extended support by the sellers could break below that level to test 41.70.

Resistance: Above 42.30, the first resistance is likely to be at 42.60. A stronger upward momentum could break above that level to test 42.80.

Disney

Disney stock has risen marginally in the last five sessions, but I expect it to pick up a stronger upside momentum in the coming days. For one, the company will release its quarterly earnings report on November 14, and that investors will likely increase their holdings of the stock in the intervening period. Analysts estimate Disney (NYSE: DIS) to report revenues of 22.6 billion, equivalent to a 6.3 percent growth rate year-over-year. Meanwhile, the EPS is expected to grow substantially to $1.09 YoY, corresponding to a growth rate of 32.09 percent.

The company continues to boast of an enviable ownership of multi-billion dollar worth of Intellectual Property (IP) library, but a key growth front is likely to emerge from its Direct to Consumer (DTC) business.

After years of drawback caused by heavy spending on technology and equipment acquisition, its DTC packages, including Disney+, ESPN+ and Hulu finally returned a profit last quarter. Therefore, the end of Capex expenditure could potentially usher in the era of revenue growth from that front. On the technical front, Disney Stock price trades above the 20 and 50 moving averages on the daily chart, providing traction for further upside.

Disney stock price prediction

Pivot: The price will likely pivot at 96.00. The buyers will be in control if action stays above that mark. Conversely, a break below it will signal control by the sellers.

Resistance: The first resistance will likely come at 96.31. Above that point, the price could test 98.60.

Support: The first support will likely be at 95.80. A stronger downward momentum could break the first support, invalidate the upside narrative and potentially test 95.58.

Home Depot

Home Depot (NYSE: HD) stock price has been on the decline in recent days, but a reversal isn’t far off. The stock has lost 2.7 percent of its value in the last five sessions. As it bounces back from near the $390 mark, the move is significant, as the level serves not only as a psychological round-figure support level, but also a neckline aligning with the lower Bollinger Band on the daily chart.

Also, the company will announce its quarterly earnings a week from now. That is likely to inject fresh volatility into the stock in the lead-up to November 12, and potentially thereafter. The company is expected to report revenues of $39.21 billion, up from $37.4 billion for the corresponding quarter last year, and EPS of $3.64 for the quarter.

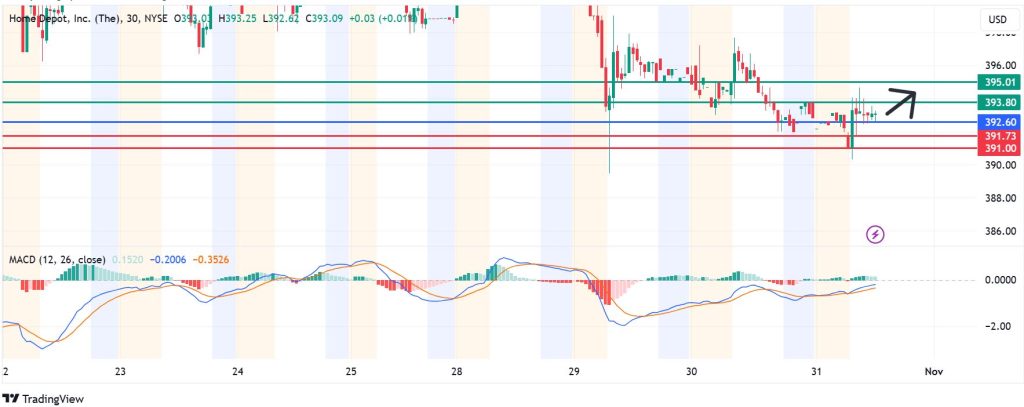

Home Depot stock price prediction

Pivot: The price will likely pivot at 392.60. A stay above this mark will favour the upside, will a break below it will signal control by the sellers.

Support: The first support will likely be at 391.73. Extended downward momentum could test the second support at 391.00.

Resistance: The first resistance will likely come at 393.80. Above that point, the price could test 395.01.