With the geopolitical tensiond in the Middle East coling down a bit, stock markets are a oscillating a bit more freely in the new week. In todays Top share price picks, we look at the performances of Nio, Lloyds Bank and Tesla stock prices

Nio

Nio stock price returned strongly to the upside on Monday, with 6.4 percent in gains within the first hour of trading at the time of writing. That was a significant reversal from the Friday decline where it went below the $5.00 mark for the first time in over a month.

On the daily chart, Nio (NYSE: NIO) is likely to stay up, as investors react to a Macquarie’s move to upgrade the stock from “neutral” to “outperform”. The firm has placed a price target for Nio stock price at $6.60, which translates to a potential 32 percent upside from the current price.

On the downside, however, Macquarie’s revision was down by 19 percent from its earlier target of $8.20. Nonethless, the firm points to potential sales growth in Q4 and market expansion as key growth drivers. Besides, Tesla’s recent earnings have proven that the EV industry isn’t as beaten up as previously thought.

Nio stock price prediction

Pivot: Nio stock price will likely pivot at 5.55. The buyers will have the upper hand above that point, while the sellers will be in control below it.

Resistance: The first resistance is likely to be at 5.64. However, a stronger upward momentum could break that barrier to test 5.70.

Support: The first support could come at 5.48. However, an extended downward momentum could break that support and invalidate the upside narrative. Consequently, a second support could come at 5.40.

Lloyds

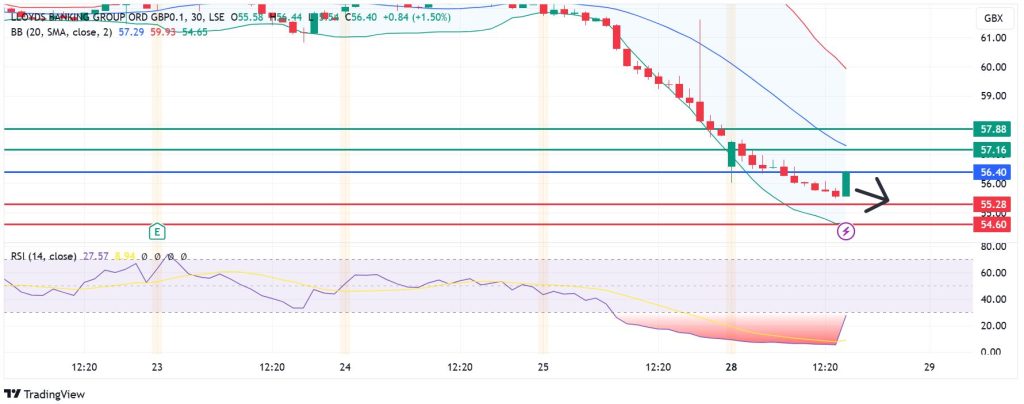

Lloyds share price traded downward by 3.1 percent at the time of writing on Monday, extending a decline that started last Friday. Lloyds (LSE: LLOY) went down by 7.3 percent on Friday after Friday’s UK court of appeal ruling that sided with consumers in a landmark case challenging the legality of discretionary commission agreements (DCE) between banks and companies offering car car finance loans. Lloyds is the UK’s leading car finance loan issuer, through its black horse division. The stock was at GBX 56.02 at the time of writing.

The court ruling means that car finance loan companies will have to divulge details of commissions to car sales agents and get customer approval before closing their sales. The court found that discretionary arrangements had denied buyers the chance to know the true value of their cars, and they typically ended up overpaying the loans to cover the agents’ commissions.

Friday’s ruling opens the lid on potential class-action claims from borrowers in an ongoing probe by the Financial Conduct Authority (FCA). Lloyds bank previously set aside £450 million to cushion itself against compensation claims by its customers.

However, the onset of a low-interest rate regime by the Bank of India could encourage more borrowing and help the bank stay on the growth path via economies of scale. On the other hand, lower interest rates will also eat up a portion of banks’ revenue margins. Despite the aftershocks of the court ruling, I expect Lloyds to bounce back in the mid-term, as its business model has proven profitable.

The bank’s revenues beat forecasts in the last three quarters, driving Lloyds share price up by 16 percent year-to-date. Therefore, a repeat of the trend in the fourth quarter could set up the stage for a stronger performance in 2025. Therefore, the near-term decline in the share price is likely to be short-lived, as investors keen on intrinsic value will be keen on buying the dip.

Lloyds share price prediction

Pivot: Lloyds share price will likely pivot at 56.40. The buyers will have the upper hand above this mark, while a move below it will favor the sellers.

Support: With resistance persisting at 56.40, the first support will likely come at 55.28. A stronger downward momentum could break below that level to test 54.60.

Resistance: Initial resistance will likely come at 57.16. However, an extended bullish control could clear that barrier and invalidate the downside narrative. Meanwhile, the gains could pile up and test 55.88.

Tesla

Tesla stock price has risen by 26 percent in the last two trading sessions, driven by forecast-beating quarterly earnings and an upbeat growth guidance. Tesla (NASDAQ: TSLA) also reported impressive figures for its supervised Full Self-Driving (FSD) product, which had $326 million in profit.

The FSD performance affirmed CEO Elon Musk’s focus on autonomous driving. Also, it added credence to the potential success of recently-revealed Cyber Cab and Robovan, which are expected to enter commercial production in 2026. Furthermore, the company projects a 20%-30% sales growth next year.

Tesla’s focus on AI puts it at a focal point relative to its EV compatitors, which could infuse a substantial revenue stream from software-related services. That is a significant departure from traditional vehicle manufacturing business model, which is typically built on vehicle and spare part sales only.

Tesla stock price prediction

Pivot: Tesla stock price will likely pivot at 266.75. Action above that level will favour the buyers. A move below that level will signal control by the sellers.

Resistance: The first resistance is likely to be at 272.45. However, an extended control by the bulls could clear that hurdle to test 279.90.

Support: The first support will likely be at 260.20. Below that mark, the upside narrative will be invalid. Instead, a second support could come at 255.10.