- Stock markets volatility is cooling, and in this Top share prediction, we tell you why Nio, Lloyds and Tesla share prices are looking up

Market sentiment has normalised after recent US data showed that the economy is not doing as bad as previously thought. However, there are concerns over the trajectory taken by China’s economy in recent days, after posting successive weak data. Despite the mixed outlook, I think that the three stocks below hold high upside potential this week.

Nio

Nio share price rose significantly on Friday, gaining 2.5 percent on the heels of news that the EV company had delivered 20,176 vehicles in August. Nio (NYSE: NIO) had been trading near year-to-date lows prior to the news, signaling that the numbers somewhat pacified the negative sentiment prevailing in the market at the time.

Why Nio share price is likely to rise

The Chinese company’s CEO, William Li stated in July that the company could break even if it manages to sell an average of 30,000 units per month. Therefore, selling over 20k units for the fourth time in a row signifies a good outlook for the company as its cheaper Onvo model enters the market. In addition, an even cheaper Firefly model will be available starting January 2025.

Nio has delivered 128,100 vehicles year-to-date, representing a growth of 35.8 percent over last year’s figures. This augurs well for the company that was once hailed as “The Tesla of China” but which is yet to return a profit after nearly a decade of existence. However, the shift in strategy to cheaper models and expansion of markets outside China could herald a turnaround in its fortunes.

Nio’s ONVO L60 model hit showrooms on September 1, and will be available across 105 stores in 55 cities in China. Also, the company’s battery swapping segment has recorded significant growth in recent months, hitting 50 million swaps in August.

Furthermore, the company recently reported that about 60 percent of its customers now swap batteries instead of charging. At an average rate of 79,000 battery swaps every day, this has saved customers 28.6 billion minutes. Going into the final third of the year, we are likely to see Nio share price rise significantly, with improving fundamentals.

Nio share price prediction

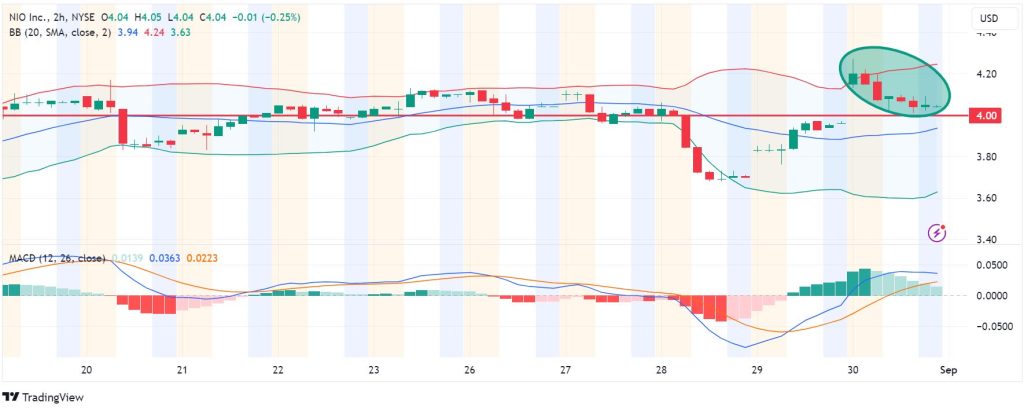

The 2-hour chart , Nio share price signals control by the buyers, above the middle Bollinger Band, which currently corresponds to $3.94. However, to maintain the upside, it will likely need to stay above the psychological round figure of $4.00. Meanwhile, the MACD indicator line is above the signal line, adding weight to the upside view.

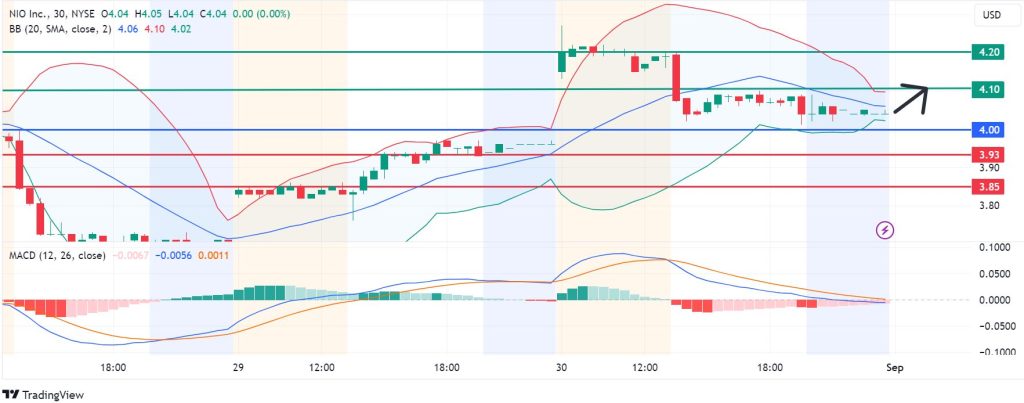

To maintain the upside momentum, NIO will need to stay above the $4.00 pivot mark as shown on the cahrt below. With the bulls in controll, the first barrier will likely be at $4.10. If they extend their countrol, they could create a stronger momentum to go above that mark and test $4.20.

Conversely, moving below $4.00 will favour the sellers, and the first support could come at $3.93. Extended bearishness could enable the sellers to breach the support, thereby invalidating the upside narrative and potentially testing $3.85.

Tesla

The EV pioneer has had a torrid run in 2024, and with weak sales figures, it is easy to see why its share price is in a trough. Tesla share price returned to the upside on Thursday and confirmed the upward breakout on Friday, with gains of +3.8 percent. In addition, the price closed above the 20-EMA, signifying a potential bullishness this week.

Bloomberg reported last week that Tesla (NASDAQ: TSLA) plans to unveil its much-awaited Robotaxi at Warner Bros. Studios, providing sci-fi undertones to the AI-powered product. That will likely generate excitement around the stock as the unveiling date draws closer.

Meanwhile, Tesla bought a 40,000-square-foot parking lot in New York in August, with reports indicating that it intends to use it for the construction of its Supercharger infrastructure. New York has a large number of Tesla Model Y taxis, and the expansion of the Supercharger network could help alleviate congestion at charging stations. Also, it indicates the company’s focus on the taxi segment as a growth area, which aligns with the Robotaxi model.

Tesla stock price prediction

The Tesla srock price is stable above the middle Bollinger Band as seen on the 2-hour chart below, but was rejected at the upper band. The MACD is also above the signal line, affirming the bullish control.

The upside will likely continue if the price stays above $212.60, from where the bulls could move further up to encounter the first resistance at $214.25. If they extend that control, it could enable them to strengthen the upside momentum to head higher to test $216.60.

On the lower side, a move below $212.60 will favour the sellers to take control. In that case, look for the first support at $210.50. Similarly, further bearishness could breach that mark and send the price lower to test $208.15.

Lloyds

Lloyds share price traded above the 20-SMA for in the second half of August, after recovering from an initial drop in the first half of the year. The bank has had a good run in the last month, with gains at 5.2 percent. The Bank commenced a £2 billion share buyback program in February 2024, with the most recent purchase involving 13,301,466 ordinary shares. That is likely to help keep the share price on the upward trajectory.

On the downside, however, the high taxation regime proposed by the UK Prime Minister Keir Starmer could eat into the bank’s revenues. The tax increases, set for October, christened “windfall tax” could potentially raise up to £14 billion by targeting the UK’s most profitable banks, including Lloyds.

Lloyds share price prediction

Momentum indicators

Lloyds share price (LON: LLOY) currently trades above the 50 and 200 Exponential Moving Average (EMA) levels but is still below the 20-EMA level on the 2-hour chart. This shows that the buyers are stilll in control, but astronger breakout could be in the offing. Meanwhile, the RSI is at 48, adding support to this view. However, the 20-EMA crossed above the 50-EMA in mid-August, signifying an underlying bullish momentum.

Support and resistance

On the chart below, the price will likely continue to the upside if it stays above the 58.30 mark. In that case, the first resistance will likely be at 58.70, but prolonged control by the bulls could enable movement past that mark to test 59.00 Alternatively, moving below 58.30 will indicate the onset of bearish control, with the first support likely to be at 58.00. However, if the sellers hold on to control at that point, it will break that support, invalidate the upside view, and potentially test 57.70.