- Summary:

- The Non-Farm Payrolls (NFP) report will be released today. Here are the implications for the USDJPY against the backdrop of new US sanctions on China?.

It’s another first Friday of the new month, and this means it is another Non-Farm Payrolls (NFP) report day. The market consensus is for the unemployment rate to drop from 3.7% to 3.6% and for 164,000 jobs to have been added in July, less than the previous month’s number of 224,000.

What makes today’s NFP report special is because it is coming two days after the FOMC cut interest rates and a day after President Donald Trump imposed new tariffs on Chinese goods. So in essence, there are competing fundamentals on the ground now. The average hourly earnings will also be released at the same time, and this is likely going to gain some attention because of the impact on wages on inflation, which ultimately will decide if the Fed will cut interest rates again in 2019.

Pre-NFP Market Occurrences

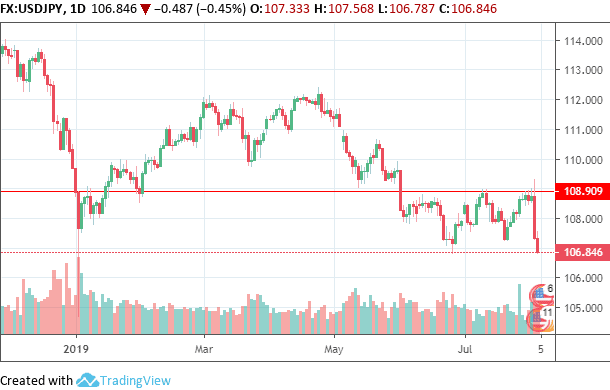

Overnight, the US imposed new 10% tariffs on $300 billion worth of Chinese goods – goods which had not been previously levied. This was coming days after Trump had tweeted that China was dilly-dallying on its promises to buy US agricultural goods. As a result, there was massive safe haven buying of the Japanese Yen, which gained 180 pips on the US Dollar to totally reverse any gains made by the USD on the rate cut announcement by the Fed.

Possible Trade Scenarios for the USDJPY

For the Non-Farm Payrolls report to be tradable, we need to see a situation where there is no conflict:

- Higher than expected employment change with a reduced or static unemployment rate. This would be USD positive. The triggers for a trade which would support buying the USDJPY would be + 224K jobs and an unemployment rate of less than or equal to 3.6%.

- Lower than expected employment change with an increased or static unemployment rate. The trade trigger to sell the USDJPY would be +104K jobs added or less, and an unemployment rate higher than 3.6%. However, due to the safe haven demand for JPY, even a slight drop in employment change below the expected number could provoke a new round of USDJPY selling.

Attention should also be paid to the average hourly earnings, which is expected to come in unchanged from the previous level of 0.2%. If it is lower than this figure, this may lead to reduced inflation and could make the Fed start mulling another rate cut.Don’t miss a beat! Follow us on Twitter.