- The BT Group share price gain on the day will face a test when the company releases its earnings report on Thursday.

According to forecasts, the BT Group is expected to declare revenue of 20.88 billion pounds for the fiscal year ended 31 March. This is a slight shortfall in revenue from the previous year, where revenue posted by the UK telecom company came in at 21.33 billion pounds. According to a poll of 17 analysts, pretax profit forecasts are set at 2.08 billion, which exceeds the actual profits made a year earlier, that stood at 1.80billion.

Ahead of the earnings report, the company also said that it was downgrading its 3rd quarter revenue forecasts by 2% due to COVID-19 impact and supply chain constraints.

It will be interesting to see how the BT Group share price will react to the earnings results scheduled for release on Thursday, 12 May.

BT Group Share Price Outlook

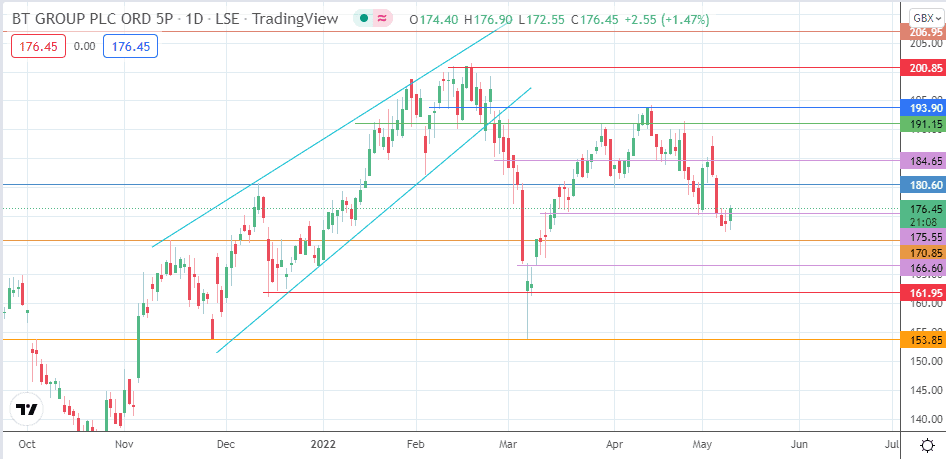

The intraday uptick preserves the sanctity of the 175.55 support level (11 March high and 18 March low). An extension of this uptick allows the price activity to challenge the resistance at 180.60 (16 March and 29 April highs). The 184.65 resistance (4 and 22 May 2022 highs) and the 191.5 barrier (12 April highs) constitute additional northbound targets that will become viable if the price activity advance continues.

On the flip side, a decline below the 175.55 support level opens the door toward the 170.85 price target. 166.60 is the site of a previous low seen on 9 March 2022, and this price mark becomes the next available target if price deterioration below 170.85 occurs. 161.95 and the 26 November low at 153.85 are additional targets to the south.

BT Group: Daily Chart

Follow Eno on Twitter.