- Summary:

- This article dissects the THETA Price action and evaluates the token's prospects in the current crypto market climate.

This article dissects the THETA Price action and evaluates the token’s prospects in the current crypto market climate.

To say the THETA token has performed horribly over the last ten months is an understatement. The token has lost a staggering 77% from the April all-time high and cannot sustain a prolonged rally. As a result, the video-streaming platform’s market cap has dropped from $14.3 billion to under $4 billion, ranking the token the 40th most-valuable cryptocurrency behind Hedera.

Several bearish factors are weighing heavily on THETA. The most significant is the increasing likelihood the FOMC will announce an aggressive reduction in asset purchases on Wednesday. But the overall weakness is due to better-performing altcoins sucking liquidity and capital from the token. Despite Samsung and Sony backing Theta, investors have favoured fast-growing Metaverse and NFT projects in the second half of 2021. As a result, the THETA price is vulnerable if the market reacts badly to the FOMC decision.

Token price Forecast

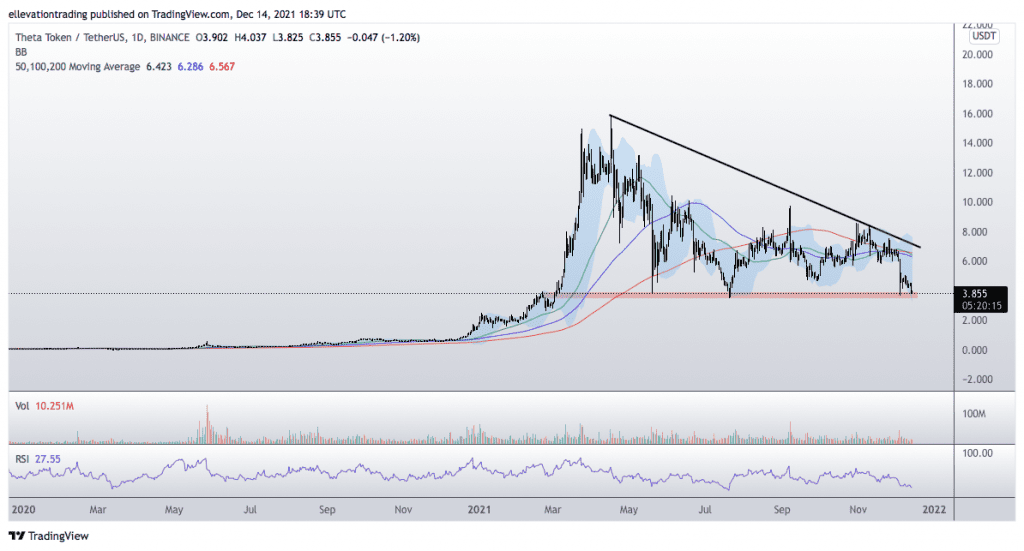

The daily chart shows the THETA price is approaching the significant support towards $3.500 (July lows). If the token breaks down through the support, it will mark a severe deterioration in the technical outlook. In that event, the first notable support is the January 2nd high at $2.51, around 37% below the current price.

However, the Relative Strength Index of 27.9 indicates the token is oversold. Furthermore, there is no guarantee the Fed will shock risk-assets lower. On that basis, selling THETA here is unwise. Instead, traders should wait for confirmation of the Fed’s decision and trade accordingly. On that basis, I am on the sidelines until a more explicit narrative emerges on Wednesday.

THETA Price Chart (Daily)

For more market insights, follow Elliott on Twitter.