- Summary:

- In our second edition issue of the Short-Squeeze report, we analyze a stock with the potential to generate out-sized returns

In our second edition issue of the Short-Squeeze report, we analyze a stock with the potential to generate out-sized returns for contrarian traders. Short-sellers have built considerable positions in the company, leaving them exposed to a short-covering rally. Furthermore, the company is trading at a historically low valuation and generating interest on the WallStreetBets retail investing forum.

Skillz Inc (NYSE: SKLZ)

Skillz Inc is an online multiplayer gaming platform providing monetization services to game developers. Currently, the company has around 18 million registered users and more than 13,000 game developers.

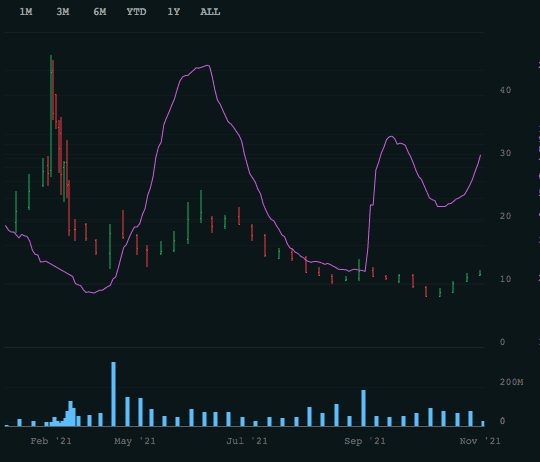

Performance

Second-quarter earnings revealed active users increased 53% YoY to 463,00. However, investors are worried about the company’s cash burn. As a result, the stock has lost -40% since the start of the year and around 75% below its 2021 high of $46.30. Interestingly, ARK invests Cathie Wood has bought over 7 million shares of Skillz stock recently. Nonetheless, the short-interest remains elevated. Furthermore, the company releases its Q3 earnings tonight, which could prove a catalyst for explosive price action.

Key Data

- Estimated Short Interest of Free Float = 22.71% ( seven day increase of +0.93%)

- Short Interest % = 59.63 million (+5.5%)

- Days to Cover = 5.41 (+1.23%)

- Utilization = 99.50% (+0.99%)

- Cost to borrow + 7.93% (+38.18%)

- Optionable = YES

Short Interest %

The short-Interest has steadily increased over the last five weeks, climbing from 18% in September to 22.71%. Logically, the higher the short interest, the greater the odds of a short-squeeze.

Days to Cover

Days to Cover is close to a 10-month high, which again highlights the potential for an exaggerated short-squeeze.

Cost To Borrow

The cost to borrow has picked up in the last two months, notably in the previous week, indicating that naked short-sellers face growing costs to maintain their positions.

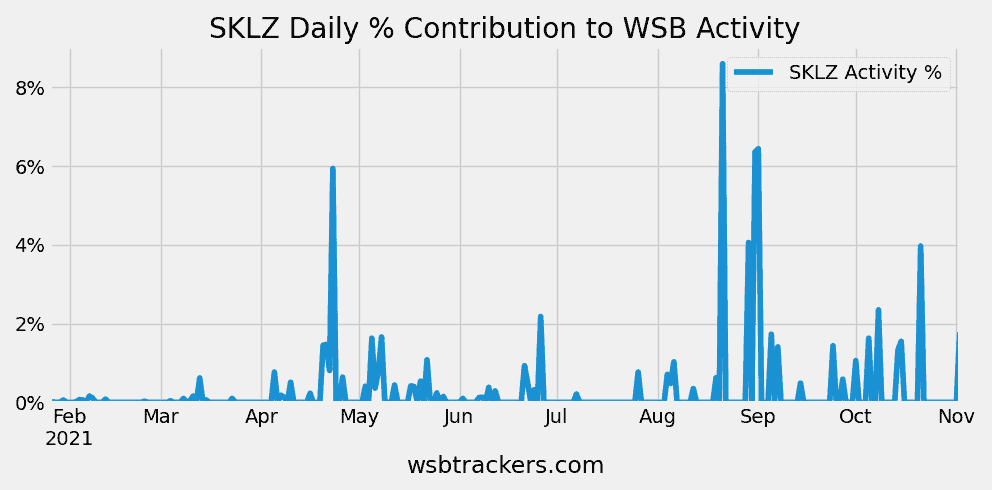

WSB Forum Activity

Although forum activity peaked in September, it has been trending higher from October through November, suggesting growing retail interest.

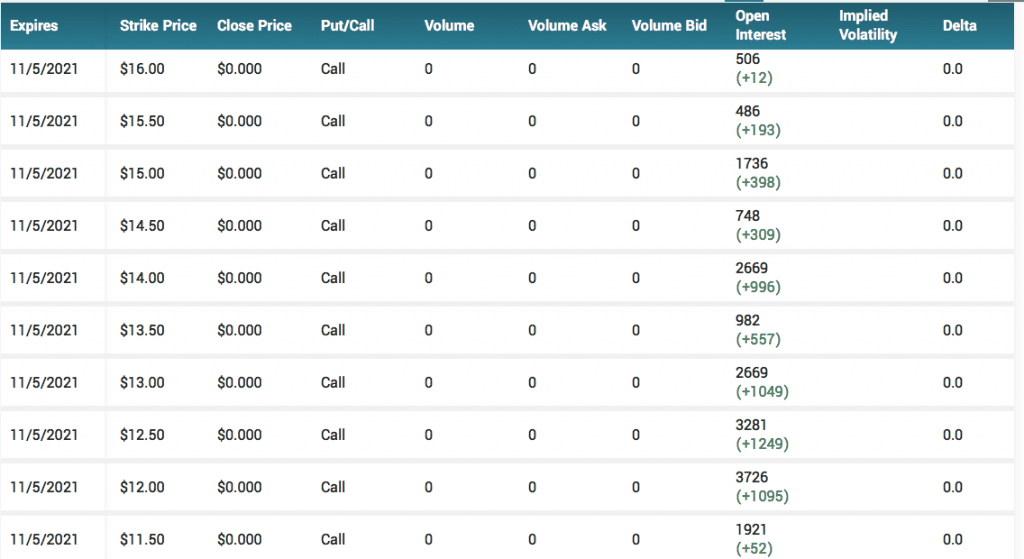

Call Option Open Interest

The increasing open interest in short-dated call options can potentially cause a Gamma-squeeze, forcing dealers to buy stock to cover their option exposure if the price starts to move higher. The options positions are particularly interesting considering Skillz releases third-quarter earnings today.

Technical Analysis

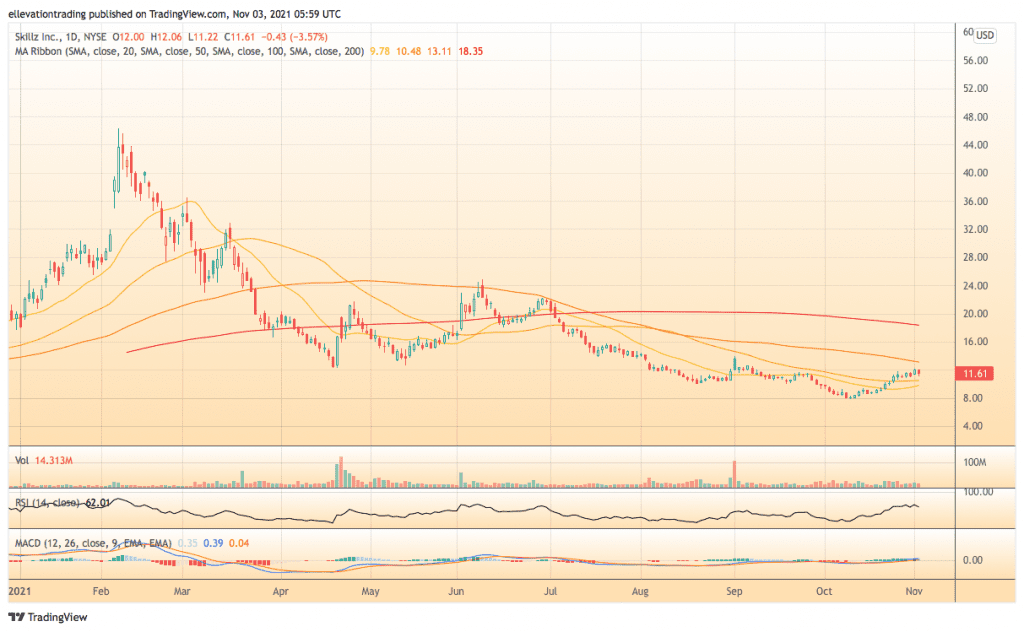

The daily chart shows Skillz is training above the 20, and 50-Day moving averages. Furthermore, the Moving Average Convergence Divergence (MACD) indicator shows that bullish momentum is increasing. The Relative Strength Index of 62.01 is also trending higher.

The 100-DMA at $13.11 and the September high of $13.98 offer resistance above the market. Successful clearance of $14.00 could trigger an extension towards the important 200-DMA at $18.35. However, considering the significant short exposure, an argument can be made for a run at the June high of $24.88. On the downside, the 50 and 100-DMA provide the first support levels, followed by October’s all-time-low of $8.05.

Summary

On balance, Skillz Inc displays all the classic signs of a potential short-squeeze. As with all squeeze plays, buying the stock does carry a certain amount of risk. However, the data is encouraging and shows that shorts are under increasing pressure. The cost of borrow and the short interest is growing. Furthermore, options positioning increases the upside stress in the near term. However, trading ahead of tonight’s earnings is hazardous. On that basis, we recommend readers take time to digest the information ahead of tonight’s trading update and stay tuned for our take on the numbers.

For more market insights, follow Elliott on Twitter.