- Summary:

- The Natwest share price is undervalued by 35% according to the bank, which predicts strong revenue growth in 2022.

The Natwest share price is undervalued by 35%, according to the bank, which predicts strong revenue growth in 2022.

Natwest Group (LON: NWG) has gained almost 7% in the last two weeks as fears over the Omicron variant subside. NWG closed Wednesday at 221.6 p (-0.23%), around 5% below this year’s 235.1p high. Like most UK banks, Natwest struggled in November when the Bank of England shocked the market by keeping interest rates unchanged. However, analysts at Deutsche Bank expect the central bank to start tightening soon, which they say will provide a material tailwind for the Natwest share price over the next 12 months.

UK Banking Sector Poised For Growth

“UK and Irish banks have some of the best revenue momentum in Europe due to rates — and we believe this should have a higher value over time.”

Deutsche bank

The research note painted a promising picture for the health of the UK banking sector. Furthermore, the bank says Natwest has the most to gain when rates eventually rise. As a result, they upgraded Natwest to buy and lifted the price target to 300p.

NWG Price Analysis

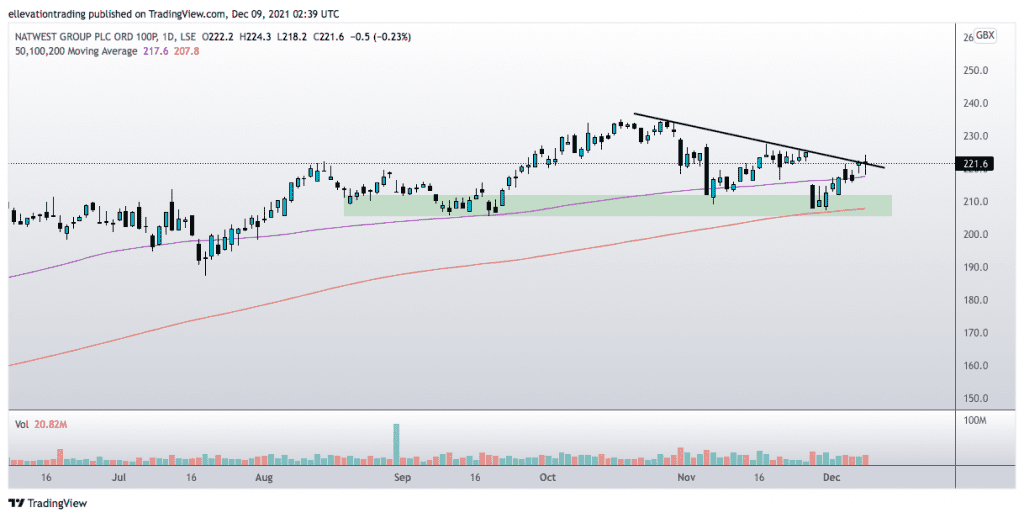

The share price chart shows that NWG is climbing out of its recent downtrend. Furthermore, the price is above the 100 and 200-Day Moving Averages. Therefore, NWG should advance towards the 2021 high at 235.1p in the coming sessions.

In my view, the outlook is constructive as long as the Natwest share price is above the 200-DMA. On that basis, a close below 207.1p suggests a breakdown, invalidating the optimistic outlook.

Natwest Share Price Chart (Daily)

For more market insights, follow Elliott on Twitter.