- Summary:

- The Nasdaq 100 index is trading lower, but has pared some of its losses as investors digest the economic recovery package of incoming US President Biden.

The US markets are all trading lower, and the Nasdaq 100 is not an exception. The Nasdaq 100 is down 0.32% currently, which translates to a drop of nearly 41 points. This is coming on the back of poor retail sales data, which are a consequence of the lockdowns associated with the coronavirus outbreak.

Retail sales and core retail sales in the US for December 2020 both fell by 0.7% and 1.4% respectively, following on from similar drops in November and also failing to meet market expectations of 0.0% and -0.1% respectively. Incoming US president Joe Biden released details of his $1.9trillion economic recovery plan, but his veiled reference to raising corporate taxes and blocking several loopholes do not appear to have gone down well with investors on the day.

Technical Levels to Watch

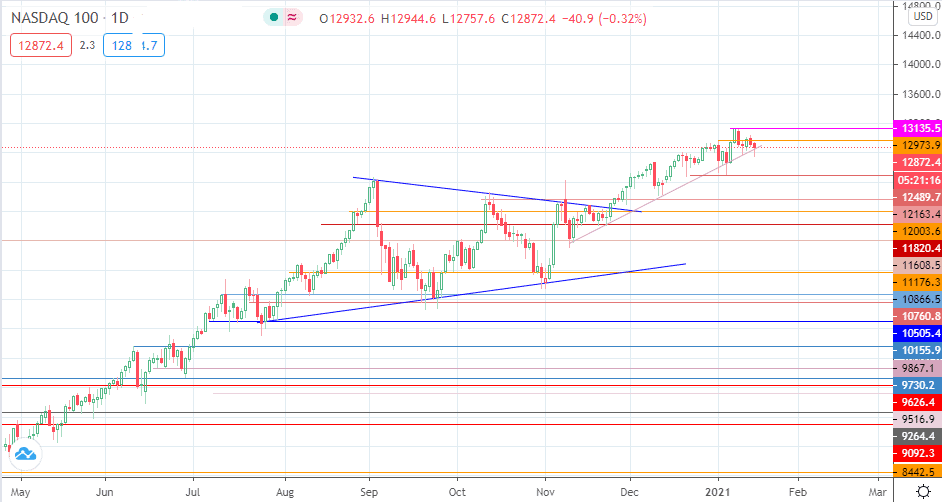

After an initial dip, the Nasdaq 100 has pared some of the intraday losses as buyers rejected a further drop that would have breached the ascending support trendline. This trendline remains the technical support for the Nasdaq 100. If this line succumbs to bearish pressure, a drop towards 12489.7 could be on the cards. 12163.4 and 12003.6 may also become available as new support levels if the price decline continues.

On the flip side, a bounce from the trendline would need to take out the resistance at 12973.9 in order for the all-time high at 13137.5 to become available. This price remains the price level to beat for buyers.

Nasdaq 100 Daily Chart