- What is the outlook of The Hut Group share price as a bidding war emerges? We explain whether the stock is a buy or sell.

The stock price of The Hut Group has done relatively well in the past few weeks as investors weigh a potential bidding war for the vulnerable e-commerce company. THG shares are trading at 140p, which is the highest level it has been since January 24th this year. Moreover, it has risen by more than almost 100% from its YTD low.

Will THG be acquired?

In my last week’s review of The Hut Group share price, I noted that the ongoing acquisition chatter would be a bullish catalyst. a few days later, it was revealed that Matt Moulding had rejected a 2 billion pound offer from Belerion Capital and King Capital Management also received a third offer from an unsolicited company. n a separate statement, Moulding said he could only accept an offer of 3 billion pounds or more.

Belerion and King are both private equity companies of different sizes. While Belerion has just 1.1 million in net assets, and King has over $20 billion in assets under management. analysts believe that more investment companies will come and present an offer for the firm. Ome of those who could be interested are PE firms like Apolo, Carlyle, and Blackstone. the first two firms have until June 16th to make an offer for the company.

Therefore, the merger talk could be bullish for the THG share price. Some analysts believe the company is worth much more than its current valuation. The sum-of-parts valuation process shows that the potential acquirer could sell some of these businesses for a profit. Some of its most valuable assets are LookFantastic, Grow Gorgeous, ESPA, and MyProtein.

The Hut Group share price forecast

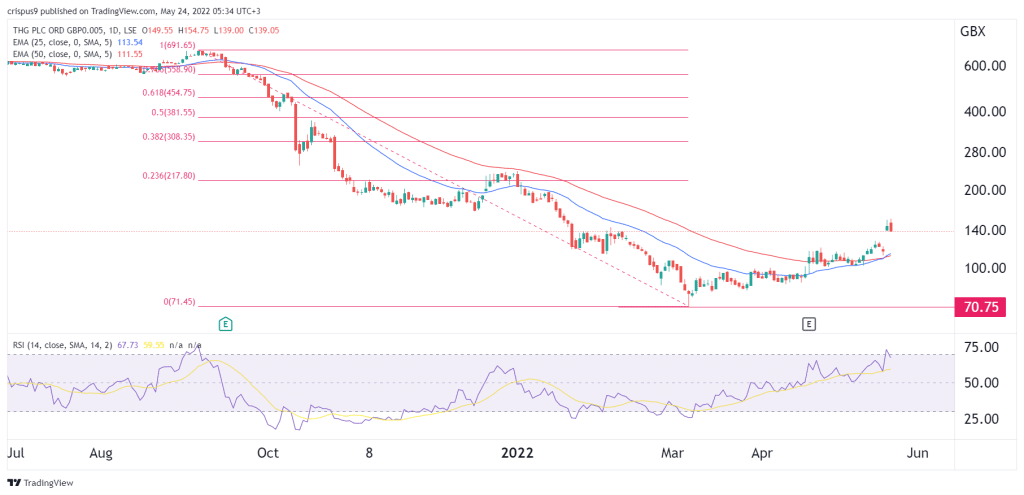

The daily chart shows that the THG share price bottomed at about $70.75 in March. Recently, the stock has been in a strong bullish trend. Notably, the 25-day and 50-day moving averages have made a bullish crossover pattern while the Relative Strength Index (RSI) has moved close to the overbought level. lso, the stock is approaching the 23.6% Fibonacci retracement level.

Therefore, the stock willl keep rising as investors wait for more news on acquisitions. If this happens, a retest of the resistance at 200p is possible. A drop below the support at 125p will stop this prediction.