- Summary:

- What is the Tesla stock price forecast? We explain whether Tesla is a good investment in the long term and identify price targets.

Table of Contents

- Tesla Stock Latest News

- Tesla’s China competition

- Tesla Full Self Driving and Robotaxis

- Tesla Deliveries Forecasts

- Tesla Sales decline in the first quarter of 2024

- Tesla earnings second quarter 2024

- Tesla Price War

- What is the Tesla market cap?

- Elon Musk Tesla ownership

- What is Elon Musk’s net worth?

- Musk Donates Tesla Shares

- Tesla Share Price History

- Is Tesla a good investment?

- Is Tesla profitable?

- Is Tesla overvalued?

- Tesla analysts forecast

- Tesla Stock Price Prediction 2024

- Tesla stock price prediction 2025 and 2030

- Tesla’s biggest shareholders

Tesla (NASDAQ: TSLA) stock price has had a weak run in August, failing to replicate the strong show seen in June and July. After gaining 11.1 percent in June and 17.2 percent in July, the EV manufacturer is down by 5 percent so far in August, with one week to spare. Its stock price trades at $218.64 as of this writing, down by -2.9 percent in the last month, and at -12.5 percent year-to-date.

The company’s stock price was resilient this week despite a much-publicised accident involving its electric semi-truck. The accident occurred on August 19 near Emigrant Gap, California, with the truck’s high-voltage battery reportedly burning for hours, while emitting temperatures as high as 1,000 degrees. The National Transport Safety Board (NTSB) has opened investigations into the accident.

CEO Elon Musk stated during the last earnings call the company would pay greater attention to autonomous driving, powered by AI. At the helm of that mission is the development of Robotaxis, whose unveiling was pushed back to October from the initial date of August 8. That will likely provide bullish undercurrent in the coming weeks.

TSLA price traded above the 20, 50, 100 and 200 period SMA on the daily chart as of this writing, denoting a bullish momentum. The company has faced major hurdles this year, ranging from CEO Elon Musk’s controversial $56 billion compensation package deal to worker layoffs, the firing of its entire Supercharger Team and a recall of its Cybertruck models. However, its biggest challenge remains stiff competition from Chinese EV makers amidst lower-than-expected sales numbers.

However, it also made significant strides, with Elon Musk negotiating his way through China’s data sharing hurdles during his visit to China in the last week of April. The move is expected to open a pathway for a wider adoption of Tesla’s Full Self Drive (FSD) service, which it considers a key growth driver.

Tesla announced during the second quarter that it will also be focusing on producing sub-$30,000 units built around the Model 2. The move is expected to make Tesla more affordable to more users, hence enable it compete with Chinese rivals.

Also,the company will be diversifying its market by producing robo-taxis, which will offer it a niche market where it could have an upper hand against its competitors. However, robo-taxis are not expected to come out of production lines over the next six years.

Tesla Stock Latest News

On June 13, Tesla shareholders will vote on whether to give or deny Elon Musk the $56 billion compensation that was previously denied by Delaware Judge, Kathaleen McCormick. The vote, if passed, will see the largest-ever compensation package in American corporate history. However, much as Musk’s contribution to Tesla has been invaluable, some view his split attention to projects outside Tesla as detrimental to the company’s growth. Therefore, that could present a barrier to Musk’s claim.

On his part, Musk has stated that he needs at least 25% control over the company to justify spending more time in the company. Currently, Musk owns about 13% of Tesla. Furthermore, his AI startup, xAI recently announced on May 28 that it had raised $6 billion in a Series B funding round with participation from Sequoia Capital and Andreesen Horowitz among others.

Tesla’s China competition

Tesla’s China rivals BYD, Xpeng and Nio reported better-than-expected deliveries in July. BYD sold 342,383 units, mostly consisting of passenger service vehicles. Xpeng delivered 11,145 smart EV units, a 4 percent growth over the June figures. The EV company’s deliveries in the first seven months of the year stood at 63,173, a 20 percent growth year-on-year.

Meanwhile, Nio sold 20,498 cars, recording the fifth consecutive month with sales above the 20k mark. Tesla does not release its monthly sales figures in China, but attributed its earnings decline to tightening competition in China.

With China offering subsidies to its EV manufacturers, US President Joe Biden announced on May 14 a four-fold increase in the tariff rates for EVs made in China from 25% to 100%. China has vowed retaliation and the move could muddy the waters for American EV manufacturers in China, Tesla included. However, the tariff hike could give Tesla the upper hand over Chinese EV rivals in the US market.

Furthermore, Tesla also announced that it had slashed prices of its Model X, Model Y and Model S vehicles by $2,000. The price cuts will be effected in the US, China, Middle East, Africa and Germany, where the price cuts have been effected on the Model 3. However, vehicles were not the only products affected by the price cuts.

The company also announced that it has reduced the price tag on its Full Self Driving (FSD) software from $1,2000 to $8,000 for its US customers. Tesla has been constantly lowering its prices in different regions since the start of 2023. While this has improved the company’s sales, the profit margins have also taken a big hit.

Tesla Full Self Driving and Robotaxis

In late March, Tesla announced the availability of Full Self Driving (FSD) Beta v12 , a software built with fully autonomous driving capabilities, including steering, accelerating and braking for other vehicles and pedestrians within its lane. Tesla CEO Elon Musk announced on March 26th that the company would offer its North American customers a free test on its FSD for a month. The announcement saw TSLA share climb more than 5% in the hours that followed, with more upside anticipated. According to Musk, the FSD has the potential to become one of Tesla’s leading revenue earners.

The software is prized at $12,000 a piece, but Tesla owners have the option of choosing a monthly subscription option ranging between $99-$199. The groundbreaking technology is touted for its safety-focused approach and the convenience it promises car owners. Furthermore, Musk has ordered that all prospective customers be offered demos on the software’s use.

The FSD v12 Beta had been on trial mode for a long period, with its deadlines pushed forward multiple times. Therefore, its official launch is likely to bring the mojo back to TSLA and could see shares rise significantly in the coming weeks.

Tesla Deliveries Forecasts

Tesla reported a quarterly decline of 8.5% in its first quarter 2024 after selling 387,000 units compared to 422,000 units in the first quarter of 2023. Nonetheless, that was still higher than any other EV maker. Tesla’s formidable rival, BYD, which had more deliveries than Tesla in the last quarter of 2023 sold 300,114 units in Q1 2024, or 77.6% of Tesla’s sales. Notably, however, BYD’s sales were up by 13% in that quarter, signaling growing competition for Tesla from the Chinese EV company.

Tesla Sales decline in the first quarter of 2024

Tesla sold 444,00 cars in the second quarter of 2024, a decrease of 4.8% decline from last year’s second quarter deliveries. Furthermore, its production fell by 11% to 411,000 during Q2 2024. The quarterly the sales figures in Q1 2024 missed analysts’ forecast of 457,000. The company reported that it produced 433,371 units during the quarter.

Tesla earnings second quarter 2024

Tesla reported revenues of $25.5 billion for Q2 2024, beating analysts’ estimate of $24.54 billion. That was an increase of 2.3 percent over a similar quarter last year. However, net income fell by 45 percent to $1.48 billion and the profit margin was lower than Q2 2023 by 11 percent. Furthermore, the profit margin was the worst in five years.

The company’s EPS was 52 cents per share, falling way short of analysts’ forecast 62 cents. However, income from battery unit sales more than doubled to $3 billion during Q2 2024. The company had reported a 55 percent decline in profits in the first quarter of 2024, and a 9 percent revenue drop.

The company expects to start selling sub-$25,000 vehicle in 2025, and this could boost its sales numbers substantially. However, while the price wars might attract more buyers, they may result in reduced profit margins in the near term.

Tesla Price War

Elon Musk’s electric car maker has also revised its prices in its two leading markets in recent times. In the United States, customers who trade in their old vehicle for a new Tesla by March 31 2024, will receive 5,000 free Supercharging miles. In February, the company offered a discount of $1,000 on its Model Y rear-wheel drive and Model Y Long Range.

In China, the company announced incentives worth about $4, 800 for customers buying existing stocks of Model 3 sedans and Model Y SUVs.

Another notable Tesla stock news was Bill Miller, a legendary investor is shorting Tesla. He warned that he would continue shorting the stock if it made more positive moves. His rationale was that Tesla was highly overvalued as it was valued at a higher valuation than the other five auto companies like General Motors, Ford, and Toyota.

What is the Tesla market cap?

The falling share prices have precipitated Tesla’s fall from the top 10 ranked companies globally by market capitalisation. The company has shed more than a third of its value in 2024 and this could create a negative sentiment around it. There are currently 3.19 billion total outstanding shares of Tesla in the market. Multiplying the current Tesla stock price of $218.15 with the total outstanding shares gives a Tesla market cap of $695 billion. That makes it the world’s 12th most valuable company by market capitalisation.

Elon Musk Tesla ownership

What is Elon Musk’s net worth?

Despite liquidating some of his stake in the EV maker in the past, Elon Musk still holds 411 million shares or about 13% of the company. At the current price of Tesla stock, this amounts to approximately $90.4 billion worth of stock.

He also has billions of dollars in cash, which he made by selling his stock last year. Notably, he has an interest in SpaceX. Elon Musk’s net worth is estimated to be over $197.7 billion, making him the third richest person globally. He has also taken loans against his shares to acquire Twitter.

Musk Donates Tesla Shares

Elon Musk has recently disclosed a Tesla stock (NASDAQ: TSLA) donation that he made in 2022 to a charity. According to the latest filing to the US regulator, the tech billionaire donated $1.95 billion in Tesla stock to charity in 2022. However, the name of the charity recipient, who received around 11.6 million shares, hasn’t been revealed.

Recently, Tesla has taken a step back from its plans to produce batteries in Germany. Instead, the EV maker will carry out the same production at its US facility due to favorable tax incentives. The discarded German battery facility was to be founded in Brandenburg, Germany.

Tesla Share Price History

Tesla launched its initial public offering in 2010. When it went public, the Tesla stock price was trading at a split-adjusted rate of $5. Since then, the TSLA stock has jumped by more than 28,000%, making it one of the best performers in the market.

While the long-term performance of the TSLA share has been good, the journey to the top has not been smooth. As shown below, the stock declined by 38% within a few months in 2015. Similarly, it then dropped by 56% within a few months in 2019. At the time, Elon Musk even warned that he had the funds secure to take the company private.

Is Tesla a good investment?

Tesla is a highly divisive company. On the one hand, there are die-hard fans like Cathie Wood who believe that the company will do well and thrive in the future. On the other side, there are analysts and investors like Scotty Kilmer and Bill Miller who believe that the promised future of EVs is only a mirage. He believes that there will be no mass demand for the company.

From a fundamental perspective, Tesla is no longer a good investment because of its valuation and competition. The company is valued at over $561 billion while companies like Toyota and Volkswagen are valued at less than $292 billion and $71 billion respectively. GM and Ford are valued at about $50 billion. Therefore, it is hard to justify Tesla’s valuation.

Further, the company is facing significant competition from incumbent companies like GM and Ford and upstarts like Rivian and Lucid. Rivian and Ford are its biggest threats because it has still not launched its truck product. Also, it is unclear whether the company’s truck will be successful since it seems like a relatively niche product.

Further, the company seems to be venturing in unchartered territory with its AI venture and focus on Robotaxis. This is a market that could require massive desruptive capabilities, considering that many people and governments still cringe at self-driving technology. If this venture fails, it could lead to massive losses by Tesla. Also, this is a long-term venture with a timeline of 6-10 years.

On the other hand, proponents say that Tesla has a strong market share in the EV industry, a strong supercharger network, and a loyal fanbase.

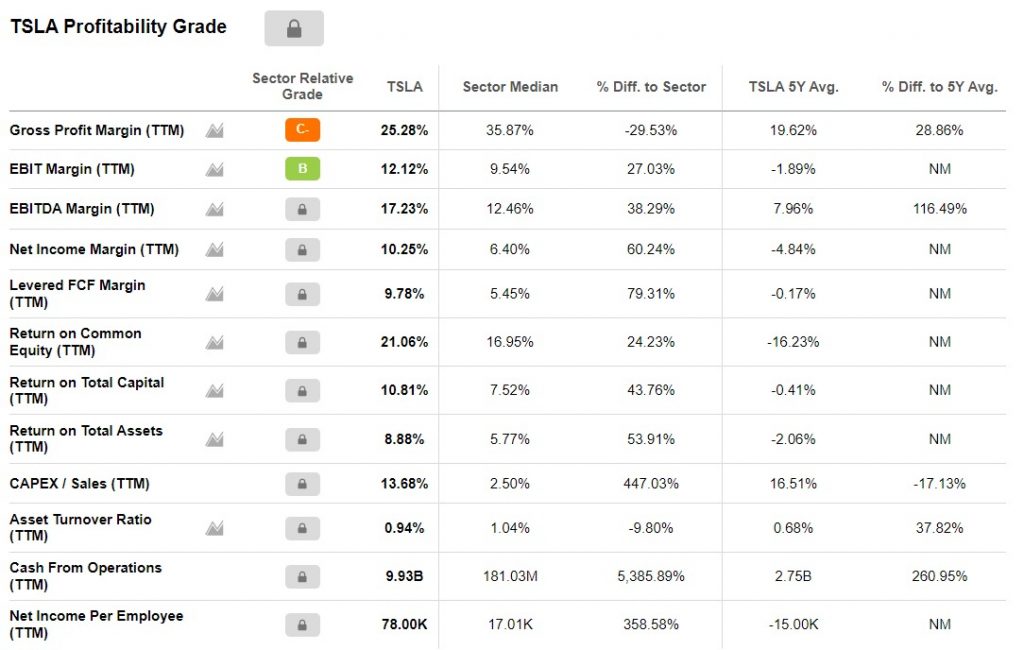

Is Tesla profitable?

A few years ago, there were concerns that Tesla would never be a profitable company. This view has changed recently when the company started making strong profits. It has a net income margin of 10%, which is expected to grow as it boosts its scale.

Tesla turned its first profit in 2020 when it made $862 million in net profit. The figure rose to more than $5.5 billion in 2021 and over $11 billion in the past four straight quarters. Tesla made a net income of $3.3 billion in Q1 of 2022 followed by $2.5 billion and $3.2 billion in the next two quarters. Also, after a 75% drawdown in 2022, Tesla stock price rebounded strongly in 2023. Therefore, we could see a repeat of the same trend in the near future.

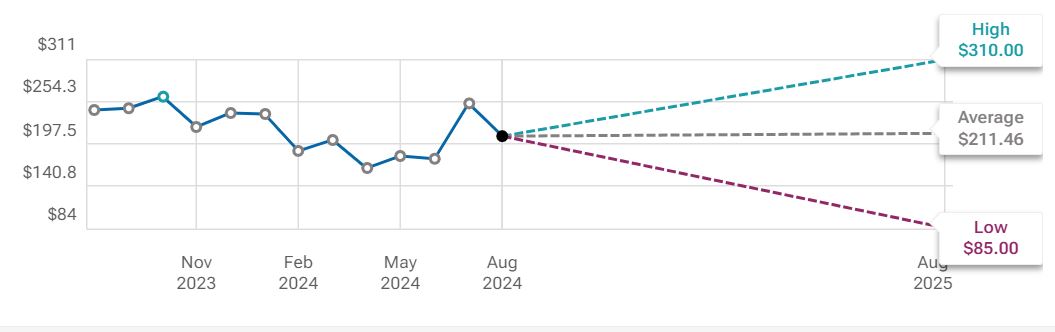

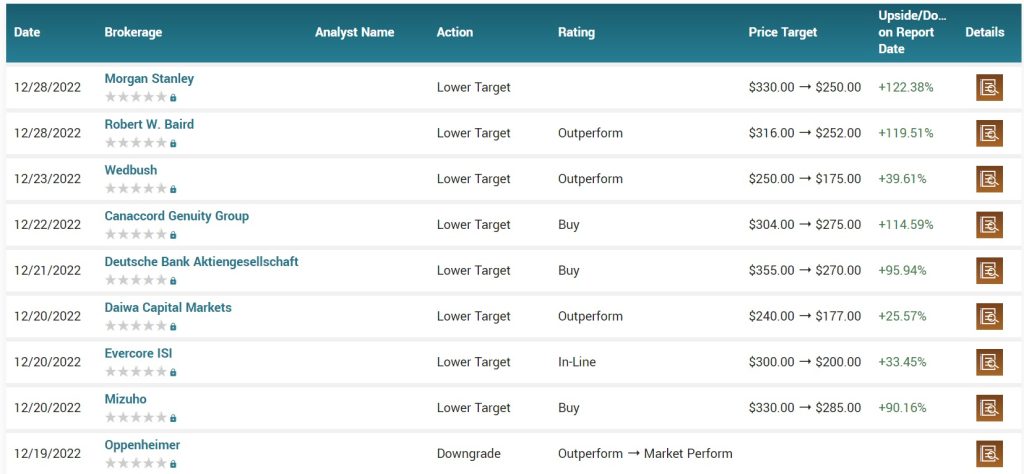

Is Tesla overvalued?

Most analysts believe that Tesla is an overvalued company. However, most of them justify this valuation because of its market share, revenue and unit growth, and upcoming projects including FSD and AI . According to a 12-month forecast by 31 analysts at tipranks.com, TSLA share price will likely be at an average of $211.46, with a high target of $310 and a low target of $85.00, signalling a substantial chance of volatility.

Tesla analysts forecast

Tesla Stock Price Prediction 2024

NASDAQ: TSLA currently trades above the middle Bollinger Band level of $211.78, and has critical support corresponding to the lower band at $188.40. Therefore, the upside will likely prevail if it stays above $211.78. However, a break below the support mark would be a red flag. Furthermore, a break above the upper band at $235.15 would denote a potential bullish rally.

Due to a lower low on the weekly chart, Tesla stock price forecast doesn’t appear to be very bullish for the next couple of months. This may change if the bulls clear the supply zone which lies above $204. Until then, there will always be another chance for the bears to make a comeback.

US inflation rate and Fed interest rate decisions will be major factors affecting Tesla shares and other US equities over the next few months.

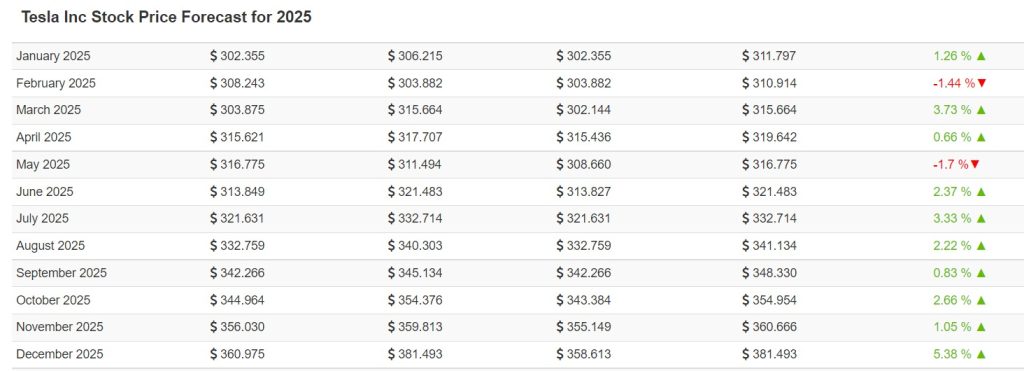

Tesla stock price prediction 2025 and 2030

I expect that TSLA shares will be significantly higher than where they are today by 2025 and 2030. At the time, the company will be highly profitable as the world moves to electric cars. As shown below, analysts at Wallet Investor expect that the stock will be trading at above $300 in 2025. Similarly, Cathie Wood believes that the stock will be over $3,000 by 2030. Ron Baron, who is a very successful fund manager, expects the TSLA stock price to hit $1500 by 2030.

Tesla’s biggest shareholders

Tesla is a publicly traded company, meaning that anyone can buy the stock. As mentioned, Elon Musk owns about 13% of the company. At the same time, there are about 1,937 institutional investors who own 41% of the company. This means that retail investors own about 42% of the company. The biggest Tesla shareholders are Blackrock, Vanguard, Capital Group, and Baillie Gifford.