- Summary:

- The Tesla share price could soon hit new gains despite the stock sale by CEO Elon Musk and NHTSA probe report requests from US Congressmen.

The Tesla share price is trading marginally higher but is yet to recover from Thursday’s slump that was triggered by calls by US lawmakers for a safety probe into the company’s electric vehicles.

The Tesla share price had plunged 2.62% in Thursday’s trading after two US Congressmen asked the National Highway Traffic Safety Administration to provide more information on the probes launched in 2021 into some crashes involving Tesla vehicles that operated with the so-called “driverless” systems.

Recall that the NHTSA had launched several probes in 2021 after some high-profile fatal crashes involving Tesla’s driver assistance systems. Tesla CEO had initially ruled out the systems as the cause of the crash. However, the company began upgrading these systems, and the NHTSA announced it would probe close to 40 crashes involving Tesla vehicles over six years.

The Tesla share price had dropped steeply on Wednesday after Musk sold $7bn worth of Tesla stock, citing a need to forestall a firesale of the stock in case an active lawsuit ruled he was mandated to follow through on the now-cancelled Twitter acquisition. This Friday, the stock is up 0.78% and could hang on to slight gains this week if it stays at the current price or higher.

Tesla Share Price Forecast

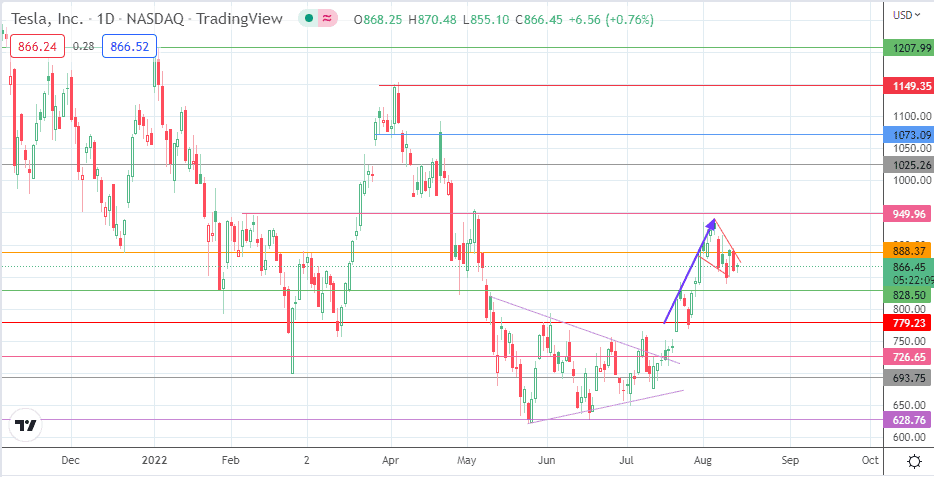

The price action on the daily chart is evolving into a bullish pennant pattern, with the 888.37 resistance level (3 March and 6 May highs) merging with the pennant’s upper border to form the price mark to beat to complete the pattern.

A breakout from here targets 949.96 initially (7 February and 4 May highs), leaving 1073.09 as the completion point of the pattern’s measured move. The bulls must take out the resistance barrier at 1025.26, formed by the 24 March/13 April highs, to clear the path for attaining this completion point. Beyond this level, further advances will meet a barrier of 1149.35 (4 April high).

On the flip side, an extension of the rejection move from 888.37, which took place on Thursday, targets the 828.50 price level as the initial downside target formed by the 26 January and 17 March lows. If the bears succeed in degrading this support, an additional push to the south invalidates the pennant. This scenario will see 779.23 become the new downside target, with other pivots at 726.65 and 693.75 forming potential harvest points for the bears.

Tesla: Daily Price