- Summary:

- Tesla could sell up to 800,000 EVs in 2021, and this could lead to a jump in revenue by 48%, according to the latest analysis of the stock by Deutsche Bank.

The latest data out of Norway for the Electric Vehicle (EV) market indicates that the Tesla Model 3 beat out VW’s ID.3 to become the highest selling EV model in that country in December. However, VW replaced Tesla as the top battery-powered car maker.

Battery electric vehicles outsold conventional fossil-fuel powered vehicles in 2020, taking up 54.3% of the market share. This is a rise from the 42.4% recorded in 2019, and a huge uptick from the 1% market share that EV cars occupied in Norway a decade ago.

The explosion in sales for EVs has been driven by state policies in countries like Norway and China. Norway aims to become free of fossil-fuel driven cars in as little as 4 years from now. Could this drive Tesla to new highs? Deutsche Bank thinks so. The bank projects that Tesla could sell 800,000 EVs in 2021, which could lead to a 48% growth in its earnings.

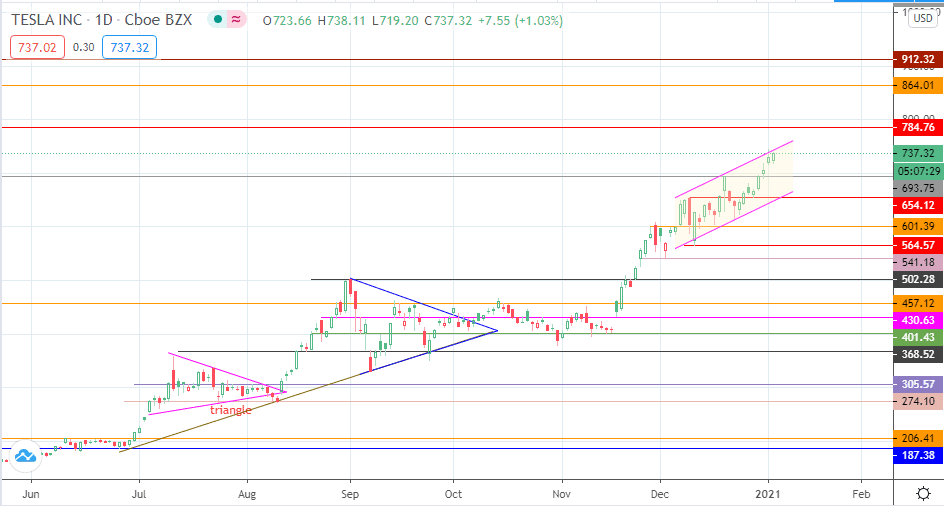

Technical Outlook for Tesla

Tesla’s share price touched off new highs (post-stock-split) on Monday, but there has been a pullback this Tuesday in keeping with the rest of the market. This price move occurs within the context of the ascending channel, with yesterday’s high being rejected at the channel’s upper boundary.

The lower boundary touches off the 654.12 support. For sellers to attain this area, the pullback move must pick up pace and break down the support at 693.75 (29 December 2020 low). Only when the channel breaks down can sellers find a target point at 601.39, with 564.57 and 541.18 lining up as additional support targets to the south.

On the other hand, new highs can be seen at 784.76 and 864.01, but only if buyers can pull prices above the channel’s upper boundary in the near term. A slower approach towards 784.76 is also possible, if the channel guides price action to the upside in the medium term.

Tesla Daily Chart