- Summary:

- The Tesco share price continues on the downward trend as new data shows a slump in supermarket sales by 4.4%.

The Tesco share price has resumed the trading day on a negative note as investors react to negative data surrounding the UK retail industry. The Tesco share price is 0.35% lower, having pared some losses. This drop continues from last week’s steep drop, where the stock fell nearly 7.5% on 17/18 May.

The fundamental trigger for the continuing downside is the latest survey of the retail market and consumer spending trends by Kantar. Kantar and NielsenQ were the first research firms to highlight the impact of rising UK inflation on consumer shopping trends and the retail market. Today, Kantar says that grocery inflation is now at 7% in the four weeks leading up to 15 May. The latest report also says 1 in 5 British households are struggling to make ends meet, with rising grocery prices now a concern in 9 out of 10 UK shoppers.

Supermarket sales have fallen 4.4% in the twelve weeks leading up to 15 May on a year-on-year basis. As shoppers look for cheaper alternatives, Aldi and Lidl have seen an increase in their market share in the UK grocery market. Investors are reacting negatively to the data, which has prompted the selloff in the Tesco share price.

Tesco Share Price Forecast

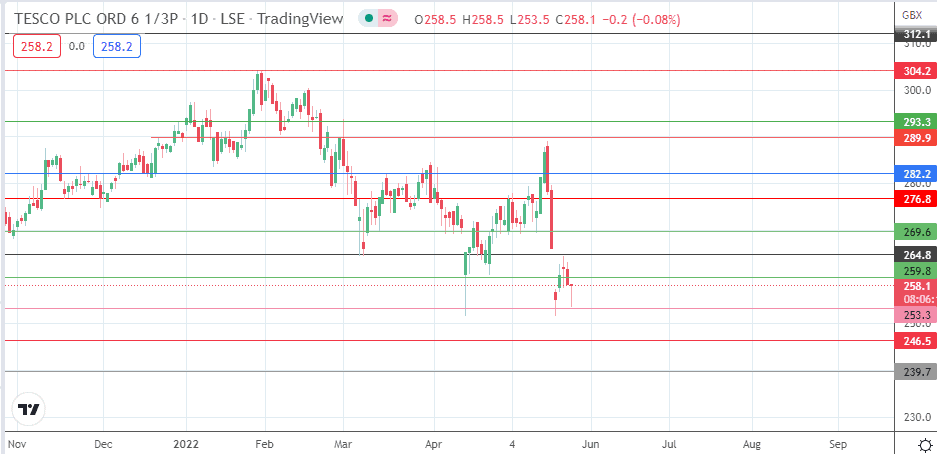

The intraday bounce on the 253.3 support level requires additional momentum to push towards the 259.8 resistance barrier (17 September 2021 high and 6 October 2021 low). A break of this resistance clears the way towards 264.8 (14 October 2021 and 8 March 2022 lows). Additional barriers at 269.8 (14 March and 12 May lows) and 276.8 become available if the bulls uncap 264.8.

On the flip side, any rallies could be seen as new selling opportunities. This makes a case for the bears to aim for 246.5 (1 October 2021 low) if the support level at 253.3 is eventually degraded. An additional downside target is seen at 239.7 (17 August 2021) and this becomes available if there is further price deterioration.

Tesco: Daily Chart