- Summary:

- Tesco share price has been ranging in the past few days as investors focus on the rising inflation and slowing economic growth in the UK

Tesco share price has been in a tight range in the past few days as investors focus on the rising inflation and slowing economic growth in the UK. The TSCO stock price is trading at 254.8p, which is about 14% below the highest level this year. Still, the stock has outperformed the SPDR Retail ETF (XRT), which has crashed by more than 33% this year.

UK consumer confidence

The Tesco stock price has been in a strong bearish trend in the past few days as investors worry about the slowing UK economy. Recent data shows that UK retail sales have dropped remarkably in the past few months as inflation stands at the highest point in decades. Most importantly, retail sales have suffered as UK’s consumer confidence has dropped sharply. Consumer confidence has a close correlation with spending.

Recent results by Tesco showed how the company’s business is struggling. Results showed that total sales for the 13 weeks to May 28th rose by just 2% to £13.57 billion. This happened as the company grew its market share by just 37 basis points in terms of value and volume. As a result, Tesco’s size has helped it to outperform its peer companies like Morrison and Sainsbury’s. In a statement, the company’s CEO said:

“Whilst the market environment remains incredibly challenging, our laser focus on value, as well as the daily dedication and hard work of our colleagues, has helped us to outperform the market.”

Meanwhile, a DCF calculation by Simply Wall St shows that the Tesco share price is undervalued by about 52%.The estimate is that the company’s stock should be trading above 500p. Further data shows that the company’s price-to-earnings ratio of 12.5x is significantly lower than the sector average of 16.9. But this multiple is also higher than that of Matks and Spencer and Sainsbury.

Analysts are also bullish on the Tesco stock price. The average estimate among City analysts is that the stock should rise to 321p, which is higher than the current level of 254p. Those optimistic about Tesco are from UBS, JP Morgan, Shore Capital, and Morgan Stanley.

Tesco share price forecast

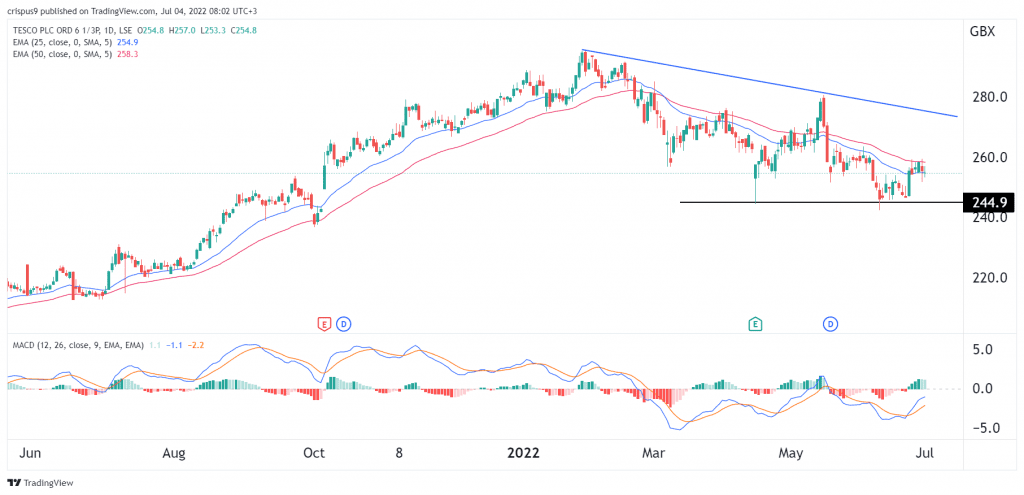

The daily chart shows that the Tesco stock price has been in a downward trend in the past few months. Now, the stock is trading at the 25-day and 50-day moving averages while the MACD is approaching the neutral point. It is also slightly above the important double-bottom pattern at around 244p.

Therefore, at this point, there is a possibility that the TSCO share price will remain in a bearish trend as long as it is below the two moving averages. If this happens, the next key support level to watch will be at 244p. A move above the resistance at 260p will invalidate the bearish view.