- Summary:

- The Tesco share price held steady at its all-time high after the relatively weak UK consumer price index (CPI) data

The Tesco share price held steady at its all-time high after the relatively weak UK consumer price index (CPI) data. The TSCO stock is trading at 275p, which is about 60% above where it was when the year started.

UK inflation and bank relief

There are two main catalysts driving the Tesco share price on Wednesday. First, data published by the Office of National Statistics (ONS) showed that the UK inflation was not as bad as expected.

The numbers showed that the headline CPI declined from 3.2% in August to 3.1% in September. On a month-on-month basis, the CPI declined from 0.7% to 0.3%. At the same time, the core CPI moved from 3.1% to 2.9%.

These numbers show that despite the recent energy crisis, prices have remained relatively steady. This is mostly because the government has put in place measures to protect consumers. However, the real impact of the situation will likely be seen in the next CPI release.

The Tesco share price is also reacting to news that Chancellor Rishi Sunak will announce a cut in the surcharge on bank profits. According to the Telegraph, the bank will reduce the surcharge from 8% to 3% in an effort to make London more competitive. This is important since Tesco owns Tesco Bank, a division that turned a profit in the most recent release. The announcement will help calm tensions now that the UK wants to increase its corporation tax from 19% to 25%.

Tesco share price forecast

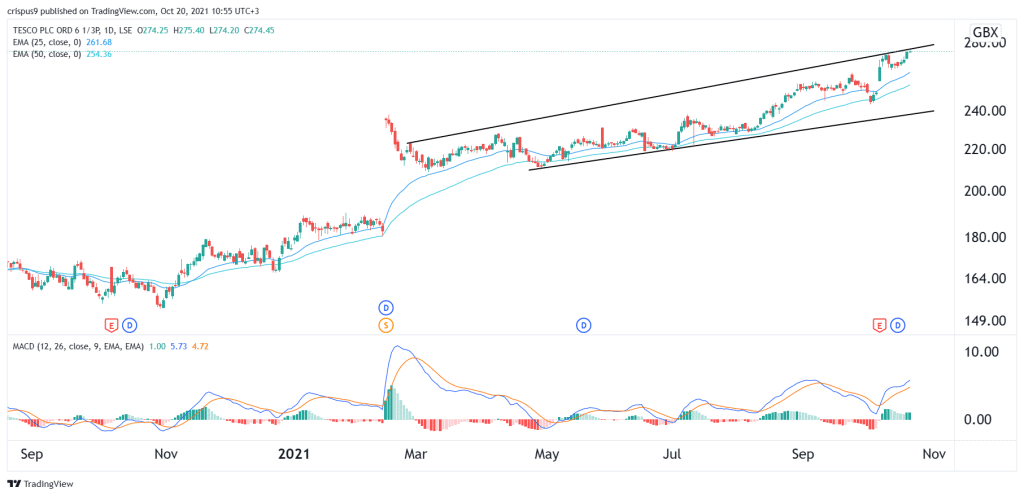

The daily chart shows that the Tesco share price has been in a strong bullish trend in the past few months. The stock has risen to the upper side of the ascending channel and is above the 25-day and 50-day moving averages. Oscillators like the MACD and the Relative Strength Index (RSI) have also kept rising.

Therefore, the shares will likely keep rising as bulls target the next key resistance level at 300p. On the flip side, a drop below 260p will invalidate the bullish view.