- Summary:

- The Tesco share price has done well in the past few months. It is trading at 276p, which is a few points below its year-to-date high of 286p

The Tesco share price has done well in the past few months. It is trading at 276p, which is a few points below its year-to-date high of 286p. It has jumped by more than 38% from its lowest level last year. Year-to-date, the TSCO share price has risen by about 12%.

Tesco, the biggest supermarket chain in the UK, has done relatively well this year. This trend is mostly because of the ongoing interest of UK retailers especially by leading institutional investors. Companies like Asda and Morrisons have already been acquired. And in November, it was reported that Apollo Global was considering making a bid for Marks and Spencer (MKS).

Tesco’s size and scale have also helped the situation. The company has managed to use its scale to mitigate the ongoing supply chain challenges. This is evidenced by the company’s recent half-year results. The company’s revenue jumped to more than 27 billion pounds. Its operating profit rose to more than 1.4 billion pounds. This pushed Tesco to boost its shareholder returns.

December will be a key month for Tesco. For one, it will be a leading month for Christmas shopping and recent data showed that UK retail sales did well in October. Therefore, with worries of the Omicron variant rising, there is a likelihood that more people will move to increase their stocks. This could be a good thing for Tesco because of its omnichannel approach.

Tesco share price forecast

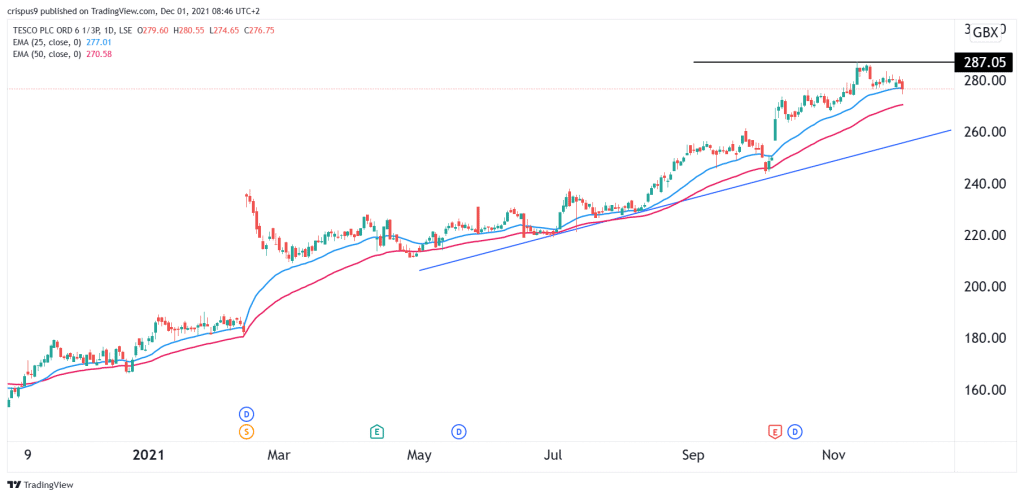

The daily chart shows that the Tesco share price has been under pressure in the past few weeks. This happened as the stock struggled to move above the key resistance level at 287p. It has dropped by about 3.7% from its highest level this year.

At the same time, the stock has managed to move to the 25-day moving average. It is also being supported by the 50-day MA. Also, it is above the ascending trendline that is shown in blue.

Therefore, there is a likelihood that the Tesco share price will resume the bullish trend in December. This view will be confirmed if the stock manages to move above the key resistance at 287p. On the flip side, a drop below 270p will invalidate this view.