- Summary:

- Tesco share price loses all its earlier gains as sentiment around UK grocery stocks sours following Beyond Meat's revenue cutback.

- Tesco loses intraday gains as sentiment on grocery stocks sours.

- Beyond Meat’s revenue outlook cutback pointing to systemic issues in UK retail industry.

- Tesco still recovering from weekend hack attempt on its grocery website and app.

The Tesco share price has lost all its intraday gains as the Beyond Meat revenue warnings spooked investors in grocery stocks. Dire warnings from haulage industry chiefs regarding UK food shortages also contributed to the sour sentiment.

Beyond Meat had cut its revenue forecast for the 3rd quarter, blaming a labour shortage (especially HGV drivers) and a drop in retail demand. This outlook generated fears among investors of a more systemic problem within the UK retail industry, triggering an intraday selloff in Tesco stocks.

UK haulage industry chiefs also have extended calls to the UK prime minister to step in to address the HGV driver shortage, saying the situation could create a bleak Christmas as shelves empty across the country.

Tesco was just recovering from an attempted hack of its website, which led to a site outage that occurred for most of the weekend. Tesco said the hackers did not access its customers’ data.

The Tesco share price is currently down by 0.29% as of writing.

Tesco Share Price Outlook

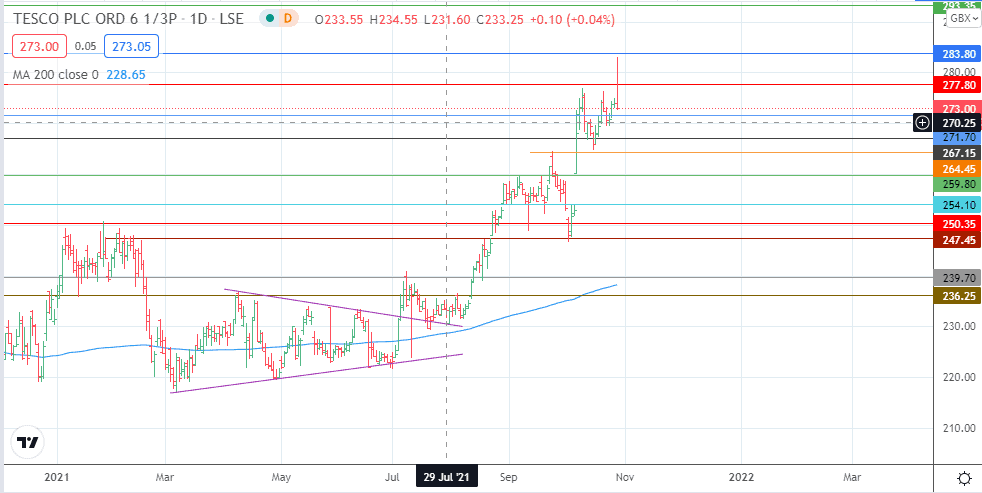

The Tesco share price’s daily candle has formed a pinbar following a strong intraday rejection from the daily high by bears. This move preserves the 277.80 resistance for now. Further bearish action requires a breakdown of the 271.70 support level. This opens the door towards 267.15, leaving the 264.45 (14 October low) and 259.80 (6 October low) support levels as the additional downside targets.

On the flip side, the share’s advance requires a break of the 277.80 resistance. If this is successful, the 28 April 2014 low at 283.80 becomes the low-hanging fruit for buyers. The 293.35 price mark (3 October 2005/1 January 2012 lows and 1 July 2014 high) lies just ahead, before the 2 June 2014 high at 306.65 comes into the picture as an additional barrier to the north.

Tesco: Daily Chart

Follow Eno on Twitter.