- Summary:

- Tesco share price closed yesterday's trading session trading at 258p, which was a drop of 0.1 percent. The bear market is likely to continue

Tesco’s share price has been on a three consecutive losing streak. In yesterday’s trading session, the share prices closed 0.1 per cent below the opening price. Part of the reason why we are seeing a drop in Tesco’s share price is the latest data that shows the UK is facing unprecedented levels of inflation.

Compared to its other G7 members, data shows that the UK has reached an inflation rate of 9 per cent. This is the highest rate the country has ever reached since the early 1980s. The high inflation rate has also resulted in most UK shoppers cutting back on the items they buy. The drop in shoppers’ ability to buy the items has meant that most Tesco supermarkets have been left with a substantial inventory.

The Tesco share price is also dropping due to the current perfect storm of Brexit, Covid, and the war in Ukraine. Brexit, for instance, has resulted in companies from the UK facing additional charges, reams of paperwork, and border delays. The result of this is reduced productivity. This has also affected the ability of Tesco and other retail supermarkets in the country to compete and has increased operating costs.

The war in Ukraine has also caused energy prices in the UK to surge. The UK is a net importer of energy, meaning it is exposed to the current global price shocks. With the war in Ukraine affecting global oil prices, UK citizens and businesses have been left with huge energy bills. For companies like Tesco, this has meant huge additional energy costs. For citizens, the rising energy costs have reduced their ability to shop, leaving Tesco with a substantial inventory.

Tesco Share Price

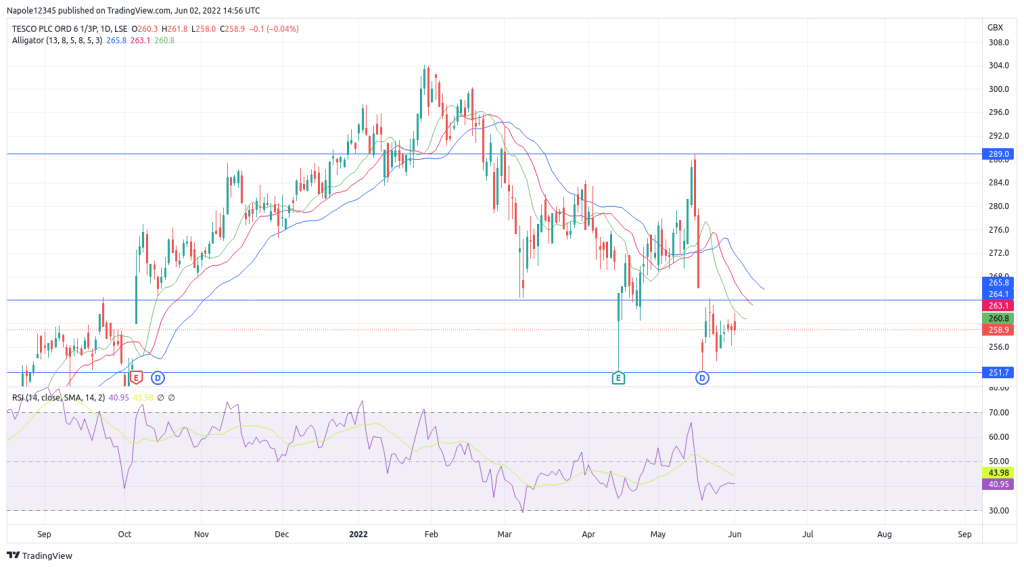

Tesco closed yesterday’s trading session at 258p. This was a 0.1 per cent price drop in the markets. The drop also marked the third consecutive day that Tesco’s share price has dropped in the market. Looking at the chart below, it is clear that Tesco has been in a long-term bearish trend for the past few months. Since the year started, Tesco has lost 11 per cent of its value.

Unfortunately, due to deteriorating market conditions, I expect the prices to continue dropping. There is a high likelihood that, in the next few trading sessions, Tesco share prices will be trading below 250p. However, if the price of energy stabilizes, the inflation rate falls, and the British Pound strengthens, my bearish analysis will be rendered invalid. The improved market conditions will likely translate into the markets and result in a Tesco share price surge.

Tesco Daily Chart