- Summary:

- The Tesco share price retains its upside bias despite the market correction it is seeing from the 2021 highs.

The bias for the Tesco share price remains bullish, despite the market correction from the 2021 highs. The Tesco share price extended Tuesday’s sharp decline by 1.10% on Wednesday, as price correction from 2021 highs continues. This is despite the brand’s dominance among UK retailers, as it grew sales by 0.4% on a year-on-year basis in the 12 weeks that preceded 6 November.

The data, which NielsenIQ provided on Tuesday, also showed that Tesco increased its market share to 26.6%, up by 0.2 percentage points. Tesco has gained market share at the expense of other supermarket brands such as Asda, Morrisons and Sainsbury’s.

The company appears set to aim for a boost in its holiday seasons sales by partnering with RangeMe. This partnership with the product sourcing platform will enable users have an improved product-sourcing experience with the UK’s largest grocer and supermarket chain.

Tesco Share Price Outlook

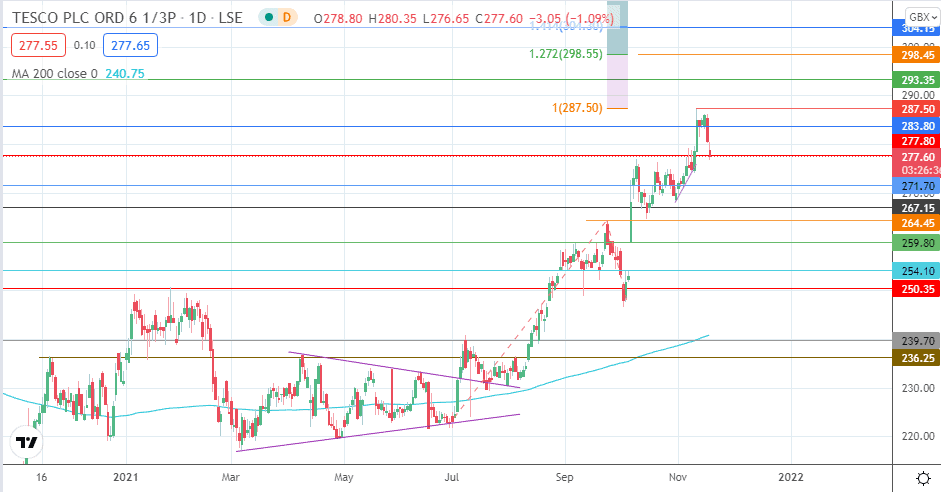

Wednesday’s decline is testing support at the 277.80 price mark. If the bulls fail to defend this price mark, the 271.70 price support comes into the picture. Additional price pressure could set up a decline to 267.15 or 264.45, depending on the extent of price deterioration.

On the flip side, a bounce on the 277.90 support allows the bulls to aim for 283.80. A further advance retests the 2021 highs at 287.50, with 293.35 and 298.45 serving as potential targets to the north.

Tesco: Daily Price