- Summary:

- Tesco's share price opened today’s trading session with a gap up and has since dropped by almost a percentage point.

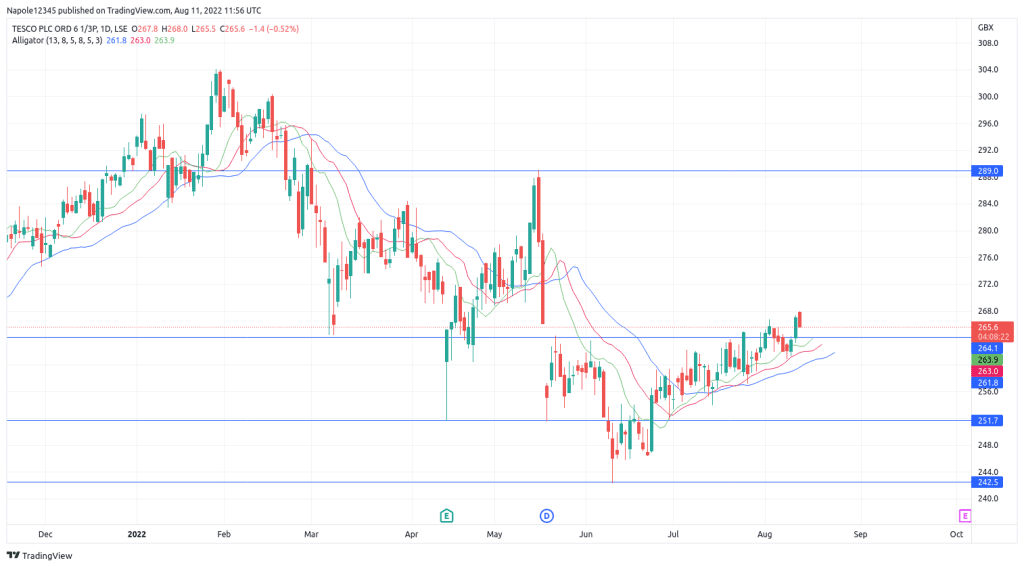

Tesco’s share price opened today’s trading session with a gap up and has since dropped by almost a percentage point. The drop follows two consecutive days of bullish trading that had seen prices rise by 2 per cent.

Tesco Recent Price History

Since June 13, Tesco’s share price has been in an aggressive push to the upside, which has seen its price surge by 9 per cent to date. However, the recent push has not been enough to wipe out losses made throughout the year. For instance, the company’s year-to-date performance shows the share price is down by 9 per cent.

This month, Tesco’s share price has traded relatively bullish, with the price already up more than a percentage point. Moreover, the past few trading session’s price action has also shown a high likelihood of the bullish trend continuation.

Part of the reason we have continually seen share price dropping is due to factors such as inflation, which has resulted in many consumers cutting down on their purchases. According to recent reports, the economic conditions have become dire to the point that Tesco and other retail stores have asked UK police to prioritize shoplifting.

Tesco Share Price

Despite today’s trading session giving bearish signals, the long-term trend for Tesco share is still to the upside. Therefore, I expect the Tesco share price to recover in the next few trading sessions. As a result, there is a high likelihood that we will see the share price trading above today’s price high of 268p.

I also expect Tesco’s share price to trade above the continue with the current bullish move and hit the 289 resistance level. My analysis will, however, be invalidated should the price trade below this month’s price low of 260p. At that point, The chances of a bear market will be high.

Tesco Daily Chart