- Summary:

- The Terra Luna price recovery has faced hurdles as investors assess its future. The LUNA 2.0 coin is trading at $4.30

The Terra Luna price recovery has faced hurdles as investors assess its future. The LUNA 2.0 coin is trading at $4.30, which is lower than last week’s high of $10.79. In addition, the price remains substantially below its all-time high of $120, when the coin was valued at over $40 billion. So, what next for Terra Luna?

Terra has made headlines in the past few months. The coin crashed hard in May as the Terra USD stablecoin lost its peg. The stablecoin is still substantially below its peg level of $1 and is trading at $0.00155, giving it a market cap of about $159 million. At its peak, UST was the third-biggest stablecoin in the world after Tether and USD Coin.

Terra 2.0 has solved some of the challenges that led to the demise of the first version. For example, the developers have given up on the algorithmic stablecoin. However, there is a possibility that the developers will launch a fully backed stablecoin to power its core projects like Anchor Protocol.

Still, the biggest challenge for Terra is that its credibility among investors has evaporated. It is hard to imagine large investors like Michael Novogratz investing in a coin affiliated with Do Kwon. Another risk is that Kwon is being sued in South Korea. They are being investigated by Seoul Southern District Prosecutors Office.

Terra LUNA price prediction

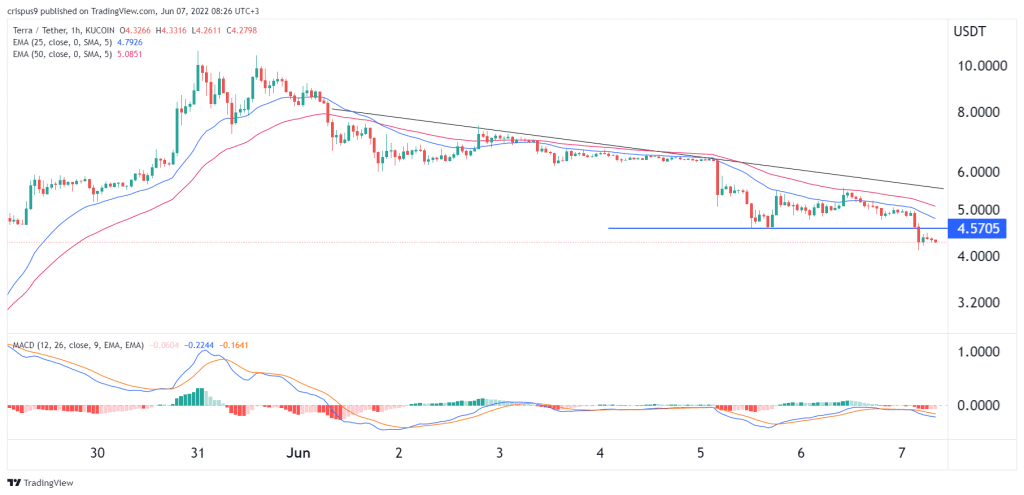

The hourly chart shows that the LUNA price has been in a strong bearish trend in the past few days. The coin has moved below the 25-period and 50-period moving averages. It has moved below the descending trendline that is shown in black, while the MACD has moved below the neutral line. Terra has moved below the important support level at $4.57, which was the lowest level on June 5th.

Therefore, there is a likelihood that the coin will continue falling as bears target the next key support level at $3.50. This view is in line with what my colleague wrote recently. A move above the resistance at $4.57 will invalidate the bearish view.