- Summary:

- What is the outlook of the Ted Baker share price amid new acquisitin intrigues as the preferred bidder withdrew the bid.

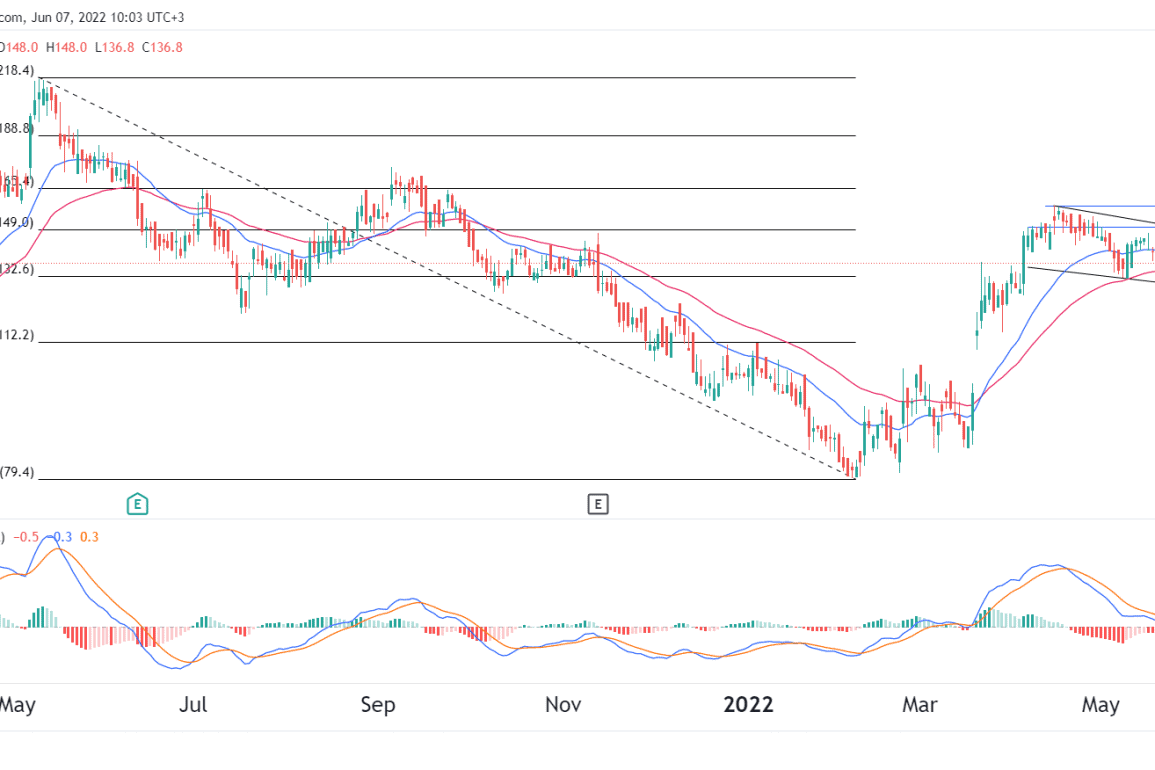

As acquisition chatter continues, the Ted Baker share price has been in the spotlight in the past few days. TED stock is trading at 136.8p, which is slightly below last month’s high of 158.6p. The current price is about 94% below the highest level in March 2018. However, it is about 72% above the year-to-date low. Its market cap has crashed to about £252 million.

Ted Baker acquisition

Ted Baker is an iconic British company that owns stores in London and other top UK cities. It also has some operations in countries like the US, Canada, Ireland, and Germany. In total, the company operates over 370 stores. Unlike companies like Boohoo and Asos, Ted Baker targets the upmarket, which has done better during the pandemic.

The Ted Baker share price is in focus as investors focus on the firm’s acquisition. Last week, it was revealed that Authentic Brands Group is considering buying the company. The bank is advising it of America. Authentic owns other brands like Reebok and David Beckham. According to reports, the firm is willing to pay 150p for the company.

The TED stock is now reacting to news that a potential bidder for the company has withdrawn from the process of buying the company. The firm did not name the preferred counterparty who dropped.

The board was informed by the preferred counterparty last night that it did not intend to proceed with an offer for the company. Therefore, there can be no certainty that an offer will be made, nor as to the terms on which any offer will be made.”

Said Ted Baker in a statement.

Ted Baker becomes the latest UK company to become an acquisition target. In May, The Hut Group said it had rejected some offers to undervalue the company. There have been talks that companies like Boohoo and Rolls-Royce Holdings could become targets. Investors view UK companies as being undervalued because of Brexit and the performance of the British pound. Ted Baker has managed to narrow its losses to 44.1 million pounds from the previous 107.7 million.

Ted Baker share price forecast

The daily chart shows that the Ted Baker share price has been moving sideways in the past few days as investors watch the bidding war. The shares are trading below the 50% Fibonacci Retracement level. The stock has formed a descending channel shown in black. This channel has a close resemblance to a bullish flag pattern.

It also consolidates along the 25-day and 50-day moving averages while the MACD has moved below the neutral point. Therefore, while a bullish comeback is possible, the upside above 150p is highly unlikely in the near term.