- Summary:

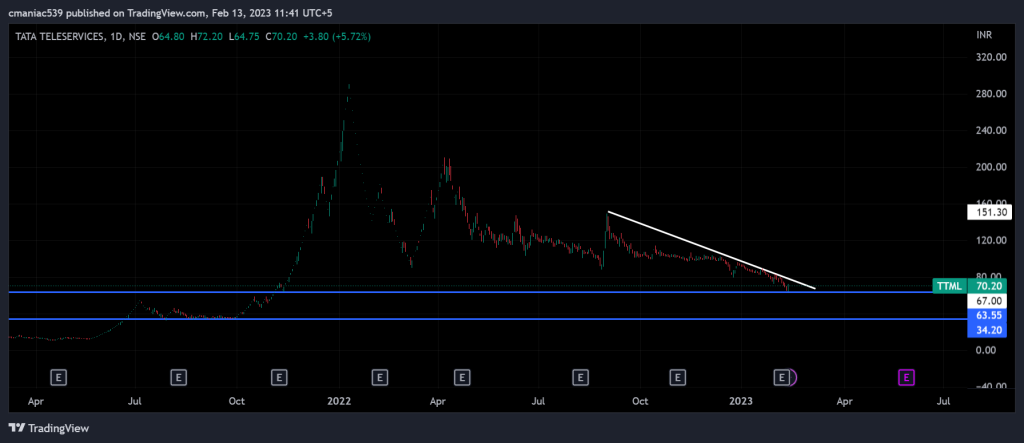

- Tata Teleservices share price remains in a downtrend. If price loses ₹65.75 level then another 50% downside is quite likely.

Not much has changed since our last week’s Tata Teleservices share price forecast. On Monday, TTML got a strong bounce from its November 2021 low of ₹64.75. The price is now trading at ₹70.85 after opening the day at ₹64.80. Nifty 50 and Sensex indices both started the week negative as investors fear an increase in retail inflation.

The S&P BSE telecommunications index showed minor gains as it increased by 0.63%. This was due to the positive price action in GTL infrastructure, Tata Telecommunication, Route Mobile, and Bharti Airtel. However, the Sensex and Nifty 50 showed minor losses during the initial hours of trading.

Tata Teleservices shares are listed in the Mumbai-based National Stock Exchange of India. The shares trade under the ticker symbol TTML. Currently, the market capitalization of the company is ₹138.8 billion. The ongoing downtrend in TTML share price is being attributed to the ₹2800 million loss in q3 of the current fiscal year.

Tata Teleservices Share Price Prediction

Technical analysis of Tata Tele share price shows that the price has crashed 78% since its January 2022 peak of ₹290. The price experienced an intense sell-off throughout 2022, and it appears to have continued in 2023. Since the start of the year, the price has already lost 32% of its value.

Nevertheless, a sigh of relief is this week’s bounce from November 2021 lows of ₹64.75. Since then, the price has gained around 7% and now trading at ₹70.80. The price needs to break out of the downward trendline to give bulls some confidence. If the price loses the ₹64.75 level in the coming days, then another 50% drop is likely.

This is because the next major support lies around ₹35. There’s also some support around the ₹53 region, which has also acted as resistance previously. At current levels, TTML remains a risky investment as the price has yet to mark a proper bottom. Buying at current prices is like catching a falling knife. However, from the long-term perspective, the current price could provide a decent accumulation opportunity.