- Summary:

- Tata Teleservices share price has crashed hard in the past few months as the market focuses on the company’s growth.

Tata Teleservices share price has crashed hard in the past few months as the market focuses on the company’s growth. The stock dropped to a low of ₹109, which was about 62% below the highest level in 2022. It has underperformed the closely watched Sensex and Nifty 50 indices, which have lagged their global peers in the past few days.

What is Tata Teleservices?

Tata Teleservices is a large company that is part of the broader Tata Group. It is a business-to-business company that offers a complete lifecycle of services like collaboration, cyber security, marketing, cloud and SaaS, and enterprise connectivity. In the latter category, the company provides voice and data solutions to some of the biggest companies in the country.

Tata Teleservices offers several key products in the IT industry. For example, it provides broadband, SmartOffice, Smart VPN, and cybersecurity solutions. However, the company’s business has experienced a relatively slow revenue growth in the past few months. With the Indian rupee struggling and inflation rising, the company has seen its revenue and profitability slow.

For example, in FY22, its revenue rose to ₹1,105 Cr while its EBITDA dropped from ₹500 cr. Its EBITDA margin and net loss also widened. At the same time, the company has faced significant competition from well-funded startup and well-established companies.

Tata Teleservices share price forecast

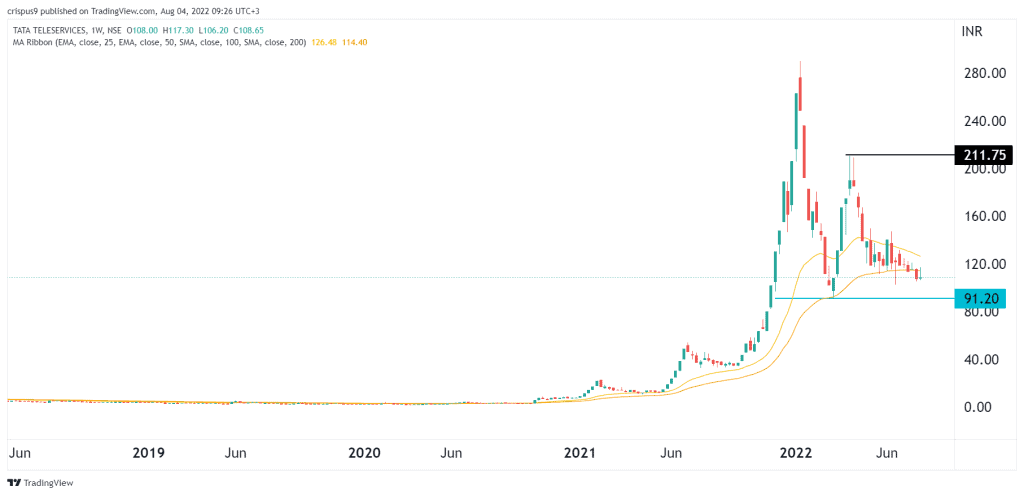

The weekly chart shows that the Tata Teleservices share price was in spectacular growth a few months ago. At the time, the company’s shares rose from less than ten INR to over 200 INR. With this growth slowing and losses rising, the shares have dropped by over 62% from the highest point this year.

It has moved below the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has been in a downward trend. This is in line with my previous TTML share price outlook. Therefore, the TTML stock price will likely continue falling as sellers target the next key support at 91.21. A move above the resistance at 120 will invalidate the bearish view.