- Summary:

- The Supply@me share price remains range-bound after the bears rejected the latest attempts at an upside break.

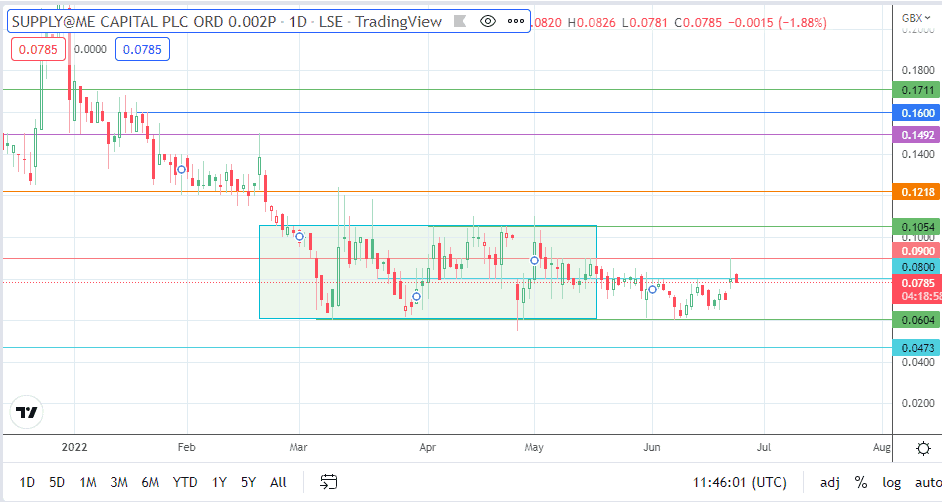

The Supply@Me share price was unable to sustain the gains of Thursday and is currently down by 1.88%. Furthermore, the daily chart reveals that the bears vehemently rejected a test of the 0.0900 resistance. This resulted in the formation of a pinbar, providing additional impetus for the bears to take control of market proceedings on Friday. Thus, the Supply@Me share price remains in consolidation for the third month in a row.

The Supply@Me share price had risen 17% at a point on Thursday, as a new partnership with a Middle Eastern entity was hailed by investors. TradeFlow Capital Management Ltd, a company owned by Supply@Me, signed a partnership with a medium-scale coffee enterprise in the UAE, allowing it to monetize the inventory of this company using the Dubai Multi Commodity Centre electronic warrants platform.

The enthusiasm that followed this move was short-lived, and profit-taking ensued to erase most of the day’s gains. However, the decline of Friday appears to be limited, and next week’s trading will reveal if the bulls have enough to make another push to the north within the context of the identified range.

Supply@Me Share Price Forecast

The price action’s rejection at the 0.0900 resistance keeps the price firmly in the range. The decline has violated the 0.0800 price support. If the bears succeed in breaking down this price mark, the 0.0604 support level (28 March and 13 June lows) becomes the price target to watch. An additional downside target is seen at the 0.0473 support level, where the previous low of 6 August 2020 is located.

On the other hand, if the bulls save the 0.0800 support level, this could allow for an opportunity to retest the 0.0900 resistance (4 April and 25 April 2022 high). A break above this resistance level allows the 0.1218 barrier to enter the picture as the next target, being the site of the 10 March 2022 high. A further advance brings in 0.1492, followed closely by the psychological resistance at 0.1600, which also houses the 21 January 2022 high.

SYME: Daily Chart