- Summary:

- The Supply@Me share price is in danger of a drop, as shareholding dilution comes on stream ahead of May 2022 financial report.

This Thursday, the Supply@Me share price is down 1.21%, adding to yesterday’s 5.39% decline. This keeps the stock trading in range-bound mode and keeps the 0.0800 support level under pressure.

This comes as the company issued a second tranche of shares to Venus Capital. The share issuance is under an equity funding arrangement with Venus Capital SA and sees 550.0 million new shares at a price of 0.05p per share. This raises the total share capital to 40.79 billion.

The share issuance dilutes the company’s shareholding structure, which is why the stock has seen a downside move this week. Supply@Me also has a drawdown agreement with Venus Capital SA, which will allow it to raise about 7.5 million pounds in new equity. The existing shareholders will also be invited to an open offer later. In addition, the company is raising funds to pay off loans and convertible notes from Mercator Capital Management.

The company is yet to publish its accounts for 2021. The process was delayed until the end of May 2022. This could decide how the Supply@Me share price ends the year’s first half. Only then will investors know how well the company is doing financially.

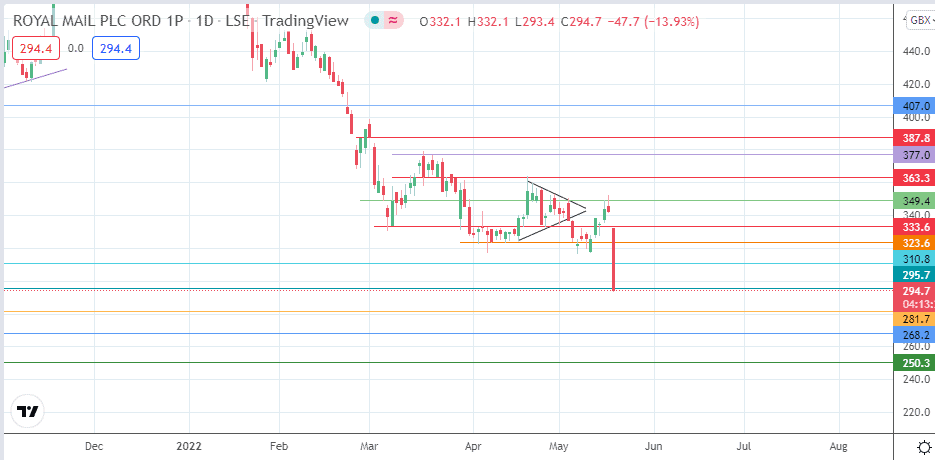

Supply@Me Share Price Outlook

The stock continues to trade in a tight range formed by the rectangle pattern. There is also an evolving symmetrical triangle within the rectangle. Recent price action is trading within the 0.0900 ceiling and the 0.0800 floor.

A break of the 0.0900 ceiling also takes out the triangle’s upper border. This opens the door for a measured move towards the 0.1218 resistance (7 December 2021 low and 10 March high). However, the rectangle’s upper border at 0.1054 must also be degraded to allow the measured move to come to fruition. Above the 0.1218 resistance, additional barriers are formed at 0.1400 (28 January high), 0.1492 (14 December and 18 February high) and 0.1600 (21 January 2022 high).

On the flip side, a decline below the 0.0800 support leads to a triangle breakdown. The new target would be the 0.0604 support (9 March and 28 April low), followed by the 0.0473 support (20 July 2020 low). If the latter is left unprotected, the price activity forms new record lows.

Supply@Me: Daily Chart