- Summary:

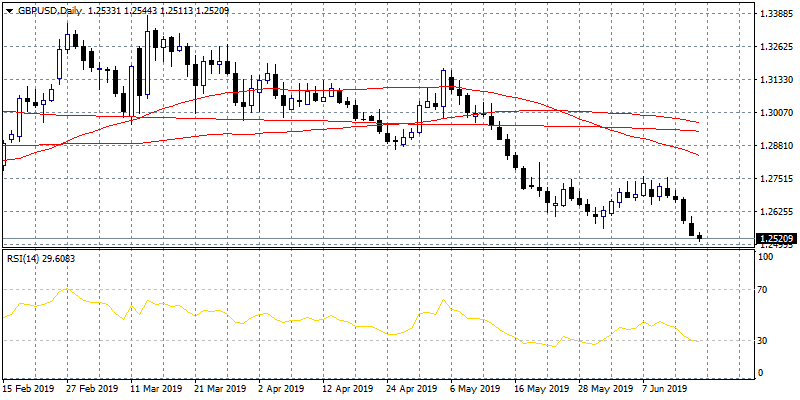

- GBPUSD trades at 1.2517 just six pips above the daily low at 1.2511 before the second round of voting for the Tory leadership later today.

GBPUSD trades at 1.2517 just six pips above the daily low at 1.2511 before the second round of voting for the Tory leadership later today. Traders and investors focus is on Wednesday’s FOMC policy meeting and policy announcement from the Bank of England on Thursday. Earlier today Mario Draghi surprised fx markets as he opens the door for an interest rate cut earlier than markets expected. I expect volatility around FOMC to be substantially higher than the most recent FOMC meetings. Wilbur Ross disappointed investors that we might get a trade deal from the G20 meeting and said the US is ready to increase tariffs on China if necessary.

Sterling broke below the trading range between 1.2680 and 1.2740 that had established for over two weeks. Friday’s sell off send the price below 1.26, and put the bears back in the driver’s seat. Support for the pair stands at 1.25 round figure, while if broken might accelerate the slide further towards 1.2480. The pair has reached oversold levels of 14-bar RSI and that might signal a rebound to 1.26 and then at 50 hour moving average at 1.2639.