- Our Stellar Lumens price prediction is giving mixed signals. This is due to the fact that XLM price has yet to give a proper reversal signal.

Our Stellar Lumens price prediction is giving mixed signals. This is because XLM price has yet to give a proper reversal signal. Some might argue that the price could have already bottomed out at the $0.16 region. Nevertheless, Stellar Lumens needs to reclaim the $0.255 level to signal a bullish reversal. Till then, Stellar Lumens price would remain in hot waters.

Latest Stellar Lumens News

As per the latest Stellar Lumens news, $44.6 million is currently locked at the network. Stellar X is the most dominant Dapp with $31.7 million TVL. Stellar Lumens has also partnered with Money Gram in 2021for cross border payments. Other XLM news includes partnerships with Argentinian and Chilean authorities to develop stablecoins pegged to their respective currencies.

Before moving on to our Stellar Lumens price prediction, let’s find out ‘What is Stellar Lumens?’. XLM is the native asset of Stellar Lumens blockchain. Stellar aims to become the global leader in cross border remittances and payments. It is developing fiat gateways for onboarding users from several countries to achieve this. Stellar Lumens has already developed multiple fiat on-ramps and key partnerships for this purpose.

Stellar Lumens Prediction

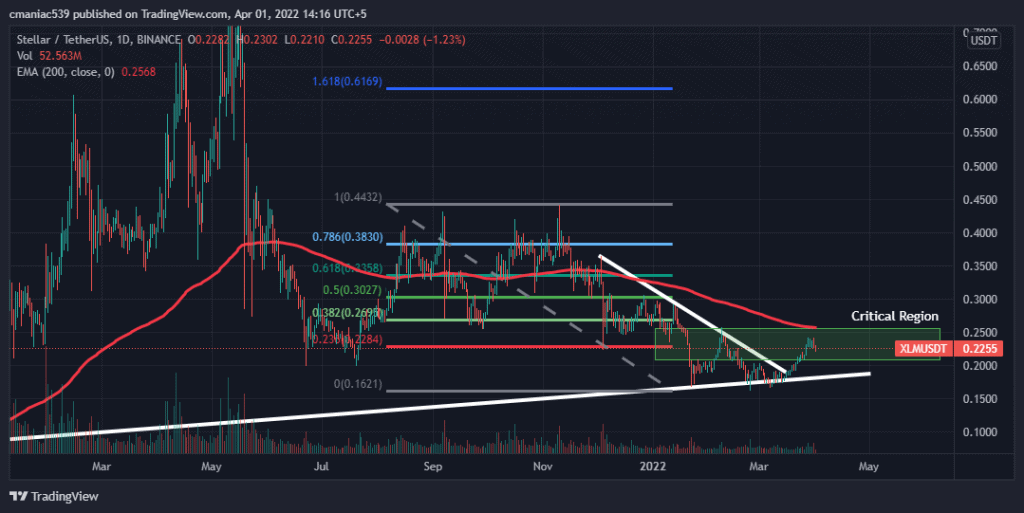

Technical analysis of the XLM price chart suggests that the recent bullish lacks volume. After a brutal start of the year for crypto markets, many cryptocurrencies are recovering. However, Stellar Lumens price appears to be lagging in the ongoing recovery. Nevertheless, XLM price prediction has gained some bullish biased after reclaiming the $0.20 level. However, to signify a proper bullish reversal, Stellar Lumens need to close above $0.255.

Any daily close above $0.255 could give bulls enough momentum to target $0.33 in the short term. This price target is a 0.618 Fib retracement level, connecting November 2021 highs to February 2022 lows. As far as Stellar Lumens price prediction is concerned, $0.55 seems to be a valid target in 2022. This price target also matches the 0.618 level. This level comes into play by joining the May 2021 high of 0.79 to the recent low of $0.16.