- Summary:

- In this Stellar Lumens price prediction, we explain whether XLM is a good asset to buy and what to expect in the near term.

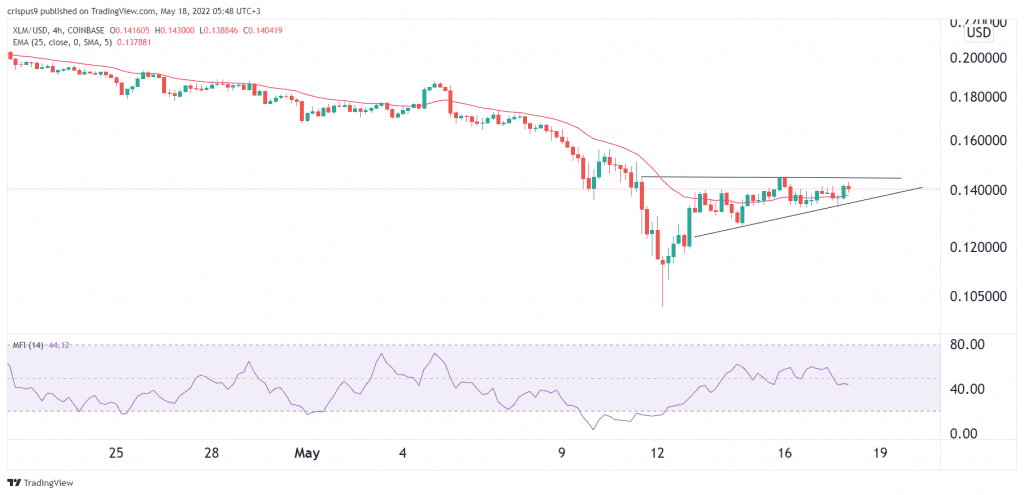

The Stellar lumens price has been stuck in a narrow range in the past few days as concerns about the cryptocurrencies industry remain. The XLM token is trading at $0.1400. This price is about 37% above last week’s low of $0.1023. As a result, its total market cap is currently $3.49 billion, making it one of the top 30 biggest digital coins in the world.

The collapse of Terra LUNA had an impact on Stellar Lumens. For one, one of Stellar’s goal is to help developers launch their stablecoins. The best-known stablecoin that uses its technology is Circle’s USD Coin, which is now the fourth-biggest coin in the world with a market cap of over $52 billion. Unlike Terra USD, USDC is fully backed by fiat currencies and is audited by a top-4 auditor.

In a statement after the LUNA Crash, Stellar advocated for strict stablecoin regulations. In their statement, the developers said that the sector should be audited in a bid to safeguard users. The statement said: “A stablecoin should be able to live up to its name. And what we’ve seen this week has proved why it’s essential to distinguish and define what is genuinely a stablecoin from what is not.”

Stellar Lumens price prediction

The XLM price has been rangebound in the past few days. A closer look at its performance shows that it is in line with what other coins like Bitcoin and Ethereum. For example, Bitcoin has remained at $30,000 while Ethereum has been stuck at $2,000. The coin also formed a hammer pattern when it crashed to a low of $0.102.

The price is oscillating at the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved slightly below the neutral level at 50. It has also formed a triangle pattern that is shown in black.

Therefore, at this point, the outlook for the Stellar Lumens price is neutral. A move above the upper side of the triangle pattern at $0.1450 will signal that bulls have prevailed. As such, it will likely keep rising as bulls target the resistance at $0.1600. A drop below the support at $0.1336 will invalidate the bullish view.