- Summary:

- The stalling of the breakout move at $0.2860 has enhanced bearish Hedera Hashgraph price predictions of a drop to $0.1980

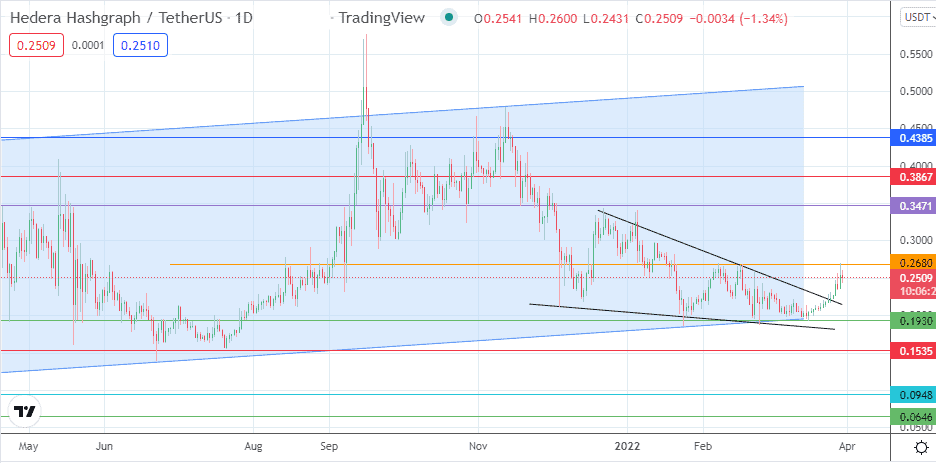

The Hedera Hashgraph price prediction is expected to be bullish, following the completion of the falling wedge pattern on the daily chart. This move follows the bounce on the 0.1930 support, which is where the lower border of the large ascending channel is located.

The intraday downturn in the crypto market on Wednesday appears to have stalled the upside move. For the bullish Hedera Hashgraph price predictions to play out, the bulls need to muster some extra bullish momentum to buck the general market trend and send the HBAR/USDT pair northwards.

The bullish trigger for the price action of Tuesday came as the HBnAR Foundation announced the launch of a $155m DeFi Fund. The so-called Crypto Economy Fund focuses on enterprise-level projects that leverage Hedera’s technology to build use cases for decentralized finance. Out of this amount, $60m will be dedicated to liquidity mining rewards for decentralized exchange platforms (DEX).

The rest will be channelled to projects that focus on building DeFi infrastructure. HBAR Director Elaine Song made these facts known in announcing the fund’s launch. The HBAR/USDT pair is currently down 1.57%, as traders have chosen to follow the market’s direction rather than the announcement by Song.

Hedera Hashgraph Price Prediction

The breakout move from the falling wedge pattern was confirmed earlier in the week. However, this move appears to have stalled, courtesy of rejection at the 0.2680 resistance mark (16/28 August 2021 highs and 7 February 2022 high).

This rejection has been followed by an intraday decline, which currently downplays prospects of an upside break of price. This scenario makes 0.1930 the most likely immediate target if the bearish momentum increases. Below this level, 0.1535 and 0.0948 are the additional targets to the south.

On the other hand, a march above 0.2680 is required to continue the measured move from the wedge’s completion. This move is expected to end at 0.3471, which is the resistance that becomes available if the bulls take out 0.2680 and the 0.3000 psychological resistance. 0.3867 and 0.4385 are additional targets to the north which only become viable if the bulls keep pressing northwards.

HBAR/USDT: Daily Chart

Follow Eno on Twitter.