- Summary:

- The Stacks price is crawling back after suffering a strong meltdown in the past few weeks. The STX coin is trading at $1.4200

The Stacks price is crawling back after suffering a strong meltdown in the past few weeks. The STX coin is trading at $1.4200, which is about 60% below its highest level in 2021. It has jumped by about 20% from its lowest level on Sunday.

Stacks is a fast-growing blockchain project that has a different model than most Ethereum-killers like Solana and Elrond. It is different in that it enables developers to build apps whose transactions are completed in the form of Bitcoin. Today, Stacks has been used to build all types of decentralized applications such as in DeFi and non-fungible tokens.

Still, based on scale, Stacks is a relatively small platform. According to DeFi Llama, there are only two DeFi platforms built using the network. These are StackSwap and Arkadiko that have a combined total value locked of just $116 million. Most of the TVL is in StackSwap, which has a TVL of more than $106 million.

Stacks price prediction

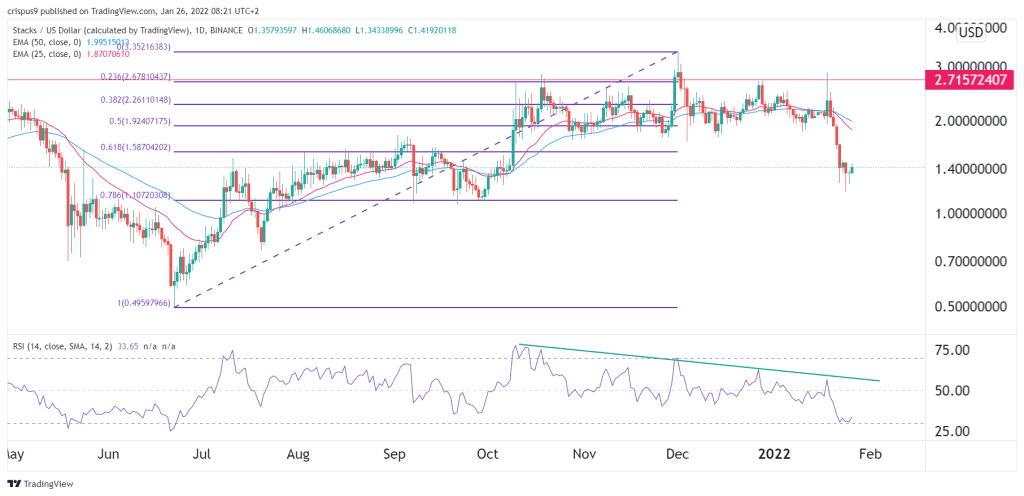

The daily chart shows that the STX price has been in a strong bearish trend in the past few weeks. The decline is mostly because of the ongoing fear about the Federal Reserve and regulation. The Fed is expected to point to about 3 or 4 rate hikes this year. Historically, cryptocurrency prices tend to underperform in a period of high interest rates.

The Stacks price remains below the 25-day and 50-day exponential moving averages (EMA) while the Relative Strength Index (RSI) has made a bearish divergence pattern. The coin has moved below the 61.8% Fibonacci retracement level.

Therefore, I believe that the rebound of Stacks is not sustainable for now and that the price will resume the bearish trend. If this happens, the next reference point will be the weekend low at $1.1750. On the flip side, a move above the resistance at $1.57 will invalidate this view.