- Summary:

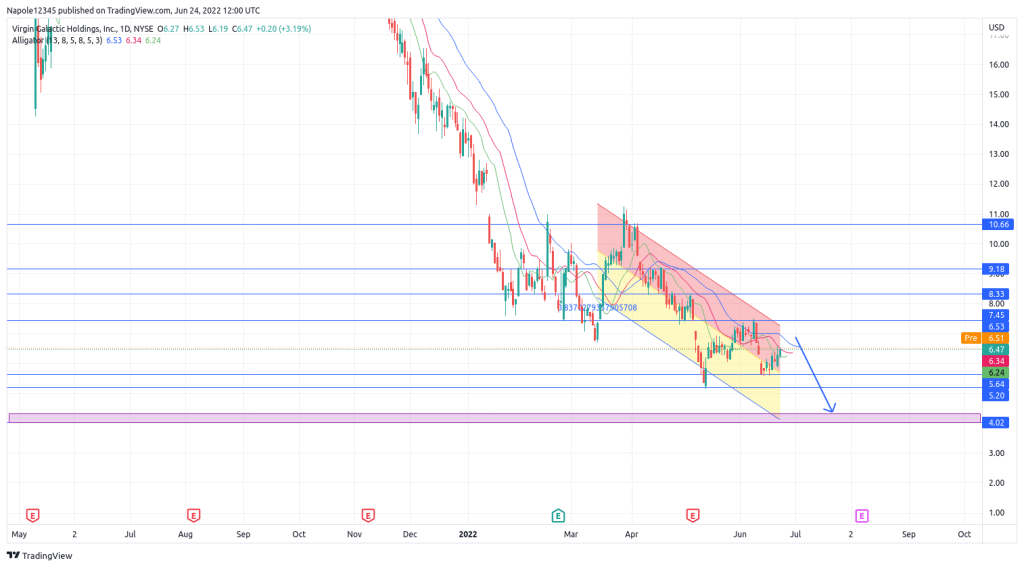

- SPCE stock price was up by 3.19 percent in yesterday's trading session. However, despite the gains, the trend still remains bearish.

Virgin Galactic holdings Inc has faced one of its toughest years in the past 12 months, dropping by $33 to currently trade at 6.47, a drop of 83 per cent during that period. The year-to-date data also shows 2022 has been a tough year for Virgin Galatic investors, where the company is already down by 52 per cent.

However, despite the long-term trend showing an aggressive bearish move that has resulted in investors almost losing all their money, the past few days have been very positive for SPCE stock. In yesterday’s trading session, the stock was up by 3.19 per cent. The surge in price was also a continuation of the past five days that have seen the prices start to gain in the markets and gain 16 per cent during that period.

Is SPCE stock price overvalued?

Despite dropping by over 50 per cent since the year started, a Wells Fargo rating believes the SPCE is still overvalued. According to a report released recently, analyst Matthew Akers gave Virgin Galactic a $4 price target rating.

Akers noted that there was a risk in investing in SPCE, casting doubt on whether the company would be able to develop its new Delta spacecraft and continue funding operations without a capital rise. However, Akers also noted that he believes retail investors partly drove the company.

Therefore, with the deteriorating economic environment, it was likely to see a decline in the company’s economic activity. His estimates put the cost of the new spacecraft development at the cost of $500 million to 1.5 billion. In addition, the company also has a burn rate of $200 million per year. This would consume around $1.2 billion in the coming years, which is a huge figure.

Unlike its competitors, such as SpaceX, which has had multiple launches in the past, Akers also noted Virgin Galactic’s continued optimism for 18 years without solid results. The reports note this as a weakness that is likely contributing to the current $4 rating.

SPCE Stock Forecast

Despite the recent market price gains, which resulted in SPCE gaining 3.19 per cent in the markets yesterday, my long-term SPCE stock price forecast mirrors Matthew Akers’ views. I expect the prices to retreat back and start trading below the $4 price level.

There is also a high likelihood that the rising inflation rates, the looming recession, and the rising Fed rates will also impact the stock price. Based on previous price action, the result will see SPCE’s stock price continuing to fall. It is highly likely that we may even see the SPCE stock price trading below $3 within the next few weeks.

SPCE Daily Chart