- Summary:

- The IHS Markits Services and Manufacturing PMI data both disappoint & indicate that business activity in the US has slowed considerably in Q3 2019.

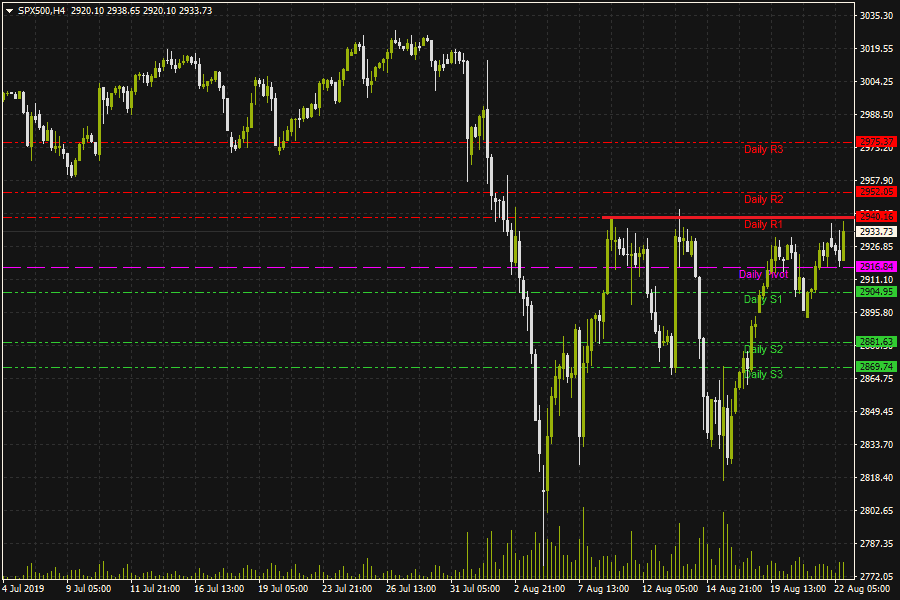

The US markets have had a muted market open today, as the IHS Markit Manufacturing and Services PMI results came out short of market expectations. The S&P500 Index is currently trading at 2931.3, having hit session highs at 2940 (R1 pivot) earlier in the session.

The IHS Markit Services PMI reading came out at 50.9, which was lower than the 52.8 figure that the analysts were expecting. The IHS Markits Manufacturing PMI figure was 49.9, which was below the 50.5 market consensus figure.

These figures are lower than the figures for the early part of 2019 and may be the first signs that business activities in the United States have started to contract. This is also the first time in a decade that the Markits Manufacturing PMI has dropped below the 50.0 mark.

At the moment, the US markets have not reacted to the figures, but it is possible that a response may be seen once the full report is digested by market players.

The S&P is currently trading in a range formed by the pivot levels, with central pivot providing support at 2916 and R1 providing resistance at 2940. If price breaks the 2916 price area, then the door will be open for a test of the 2904 and 2881 price levels. 2952 and 2975 are the upside targets to attain if price is able to break the 2940 resistance.