- S&P 500 Index Forecast: Technical analysis suggests, SPX still has more upside and may retest 4,500 level in the coming weeks.

The S&P 500 (INDEXSP: .INX) index is one of the major benchmarks of US equities. The index tracks the stock performance of the top 500 companies in the US. After a sharp decline from its all-time high in 2022, SPY has made a strong comeback in 2023.

This week, the US equities continued their gains after a positive price action last week. The S&P 500 index rose 0.12% on the first trading session of the day. The markets are set to open on Wednesday after the 4th of July holiday. There are multiple factors fueling the ongoing stock market rally.

S&P 500 Index Is 27.5% Up From October Lows

After months of downtrend, the US stock started to bounce in October 2022. This rally caught fire when the new year started, and the stocks of most S&P 500 companies soared. Currently, the index is 27.5% up from last year’s lows and 16.5% up from its yearly opening. The latest analysis reveals that SPDR S&P 500 ETF Trust (NYSEARCA: SPY) still has more upside.

A significant decrease in inflation is one of the biggest tailwinds for the S&P 500 index. A recent pause in rate hikes has given even more confidence to investors. However, it is still unlikely that the rally may continue for long as there are at least another two rate hikes scheduled for later this year.

S&P 500 Index Forecast 2023

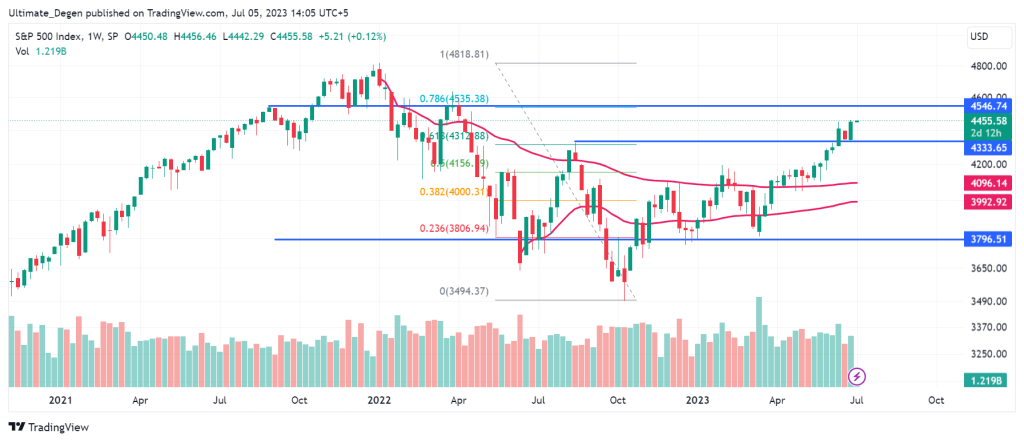

While the NASDAQ 100 index is retesting its resistance level of 15,200 points, SPX still seems to have slightly more upside. In the coming days, a retest of the 4,500 level is very likely. This will be a key retest as this region is a historical resistance that lies at the 0.786 fib retracement level.

The S&P 500 index forecast will be dependent on future Fed policies. If the Fed opts to keep rates high for more than a year, then the stock market will need to correct a lot. The June 2023 CPI data and July FOMC meeting will set the tone for the rest of this year.

In the meantime, you can also follow me on Twitter, where I share my personal trades and real-time outlook on US stocks.