- Summary:

- US indices take a slight hit after rising US bond yields forces traders to sell off their holdings on the S&P 500 index after the US Labor Day holiday.

The S&P 500 index and other US markets all opened lower on what is turning out to be a muted day of trading, following the US Labor Day holiday on Monday.

The rise in US bond yields for the second day in a row has got traders gravitating away from stocks and into bonds, which is why the S&P 500 index and other US indices are trading lower on the day.

The S&P 500 index is down 0.17% as of writing.

Outlook for the S&P 500 Index

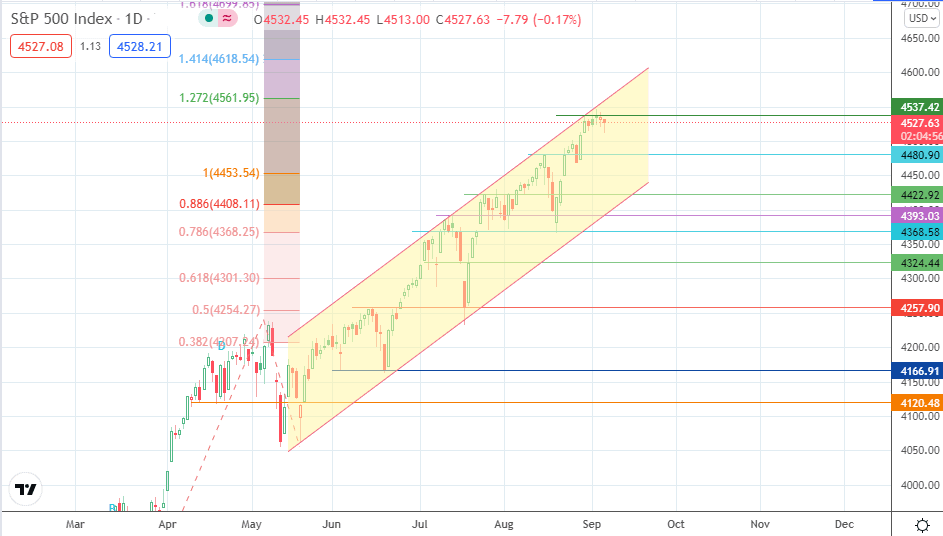

The rejection at 4537 has allowed for a slight dip on the day. Bears would need extra momentum to send prices towards 4480.90. A breakdown of this support allows 4422.92 to come into view. However, a further break of the channel’s trendline is required to bring 4393 and 4368 into the picture. 4324 and 4257 are additional targets to the south.

On the other hand, bulls would be hoping to break the resistance at 4537 to usher in a new high, which could be at 4561.95 initially (127.2% Fibonacci extension), and also at 4618.54 (141.4% Fibonacci extension). This move would probably come from a bounce following a dip to the 4480 or 4422 support levels.

S&P 500 Index: Daily Chart

Follow Eno on Twitter.