- Summary:

- The SP 500 index is trading lower on the day due to poor Retail Sales and Industrial Production data for December.

A combination of poor retail sales data and a surprise decline in Industrial Production for December have led to a drop in the SP 500 index this Friday. After opening lower by nearly 22 points, the SP 500 index has pared some of these losses, but the upside remains limited.

Thursday’s steep 1.42% decline was followed by a bearish gap as the markets opened on a steeply negative note. In December, US Industrial Production fell 0.1% in a shocking decline, after analysts expected a 0.2% expansion. November’s figure was upgraded to 0.7%, making the drop in December more significant.

Retail sales for December fell 1.9%, which was a much steeper drop than the expectation of a 0.1% decrease. November’s figure was revised to a 0.2% increase. The core figure showed a 2.3% decline compared with a market consensus for a 0.1% gain. The drop was attributed to the rise in the Omicron variant of the coronavirus in the US, holding back shoppers in what was supposed to be a bumper month within the holiday shopping season.

Despite the poor data, bargain hunters appear to have stepped into the market to reverse the earlier losses of the index. The SP 500 is now trading 0.16% lower as of writing.

SP 500 Outlook

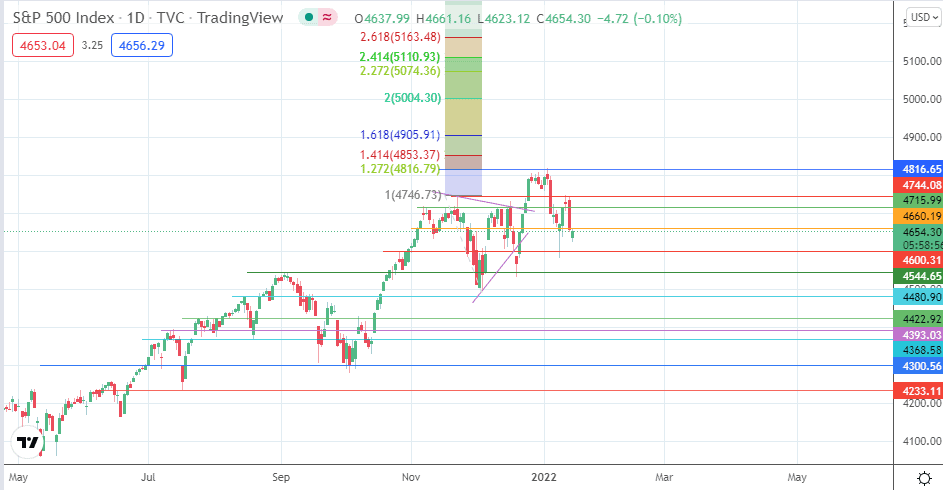

The intraday rise from the bearish gap has met resistance at the 4660 price mark. Resumption of selling here sends the index towards the 4600 support level. 4544 is another target to the downside if the selling continues.

However, a recovery move above 4660 staves off this decline, allowing the bulls a chance at targeting 4715. 4744 and 4816 remain additional targets to the north.

SP 500: Daily Chart

Follow Eno on Twitter.