- Summary:

- A slight drop in the initial jobless claims figure allowed the S&P 500 to touch off a new record high, but this move appears capped.

The S&P 500 index has hit a new record high after a combination of stimulus hopes and a better-than-expected jobless claims report sent investors into a buying mode.

Data from the Bureau of Labor Statistics showed that initial jobless claims came out at 900K, which was lower than the 926K (a downward revision) that was recorded last week, and the 930K that markets had expected. Continuing jobless claims also fell from 5181K (a downward revision) to 5054K. However, the market reaction to the news was muted as the current levels of jobless claims remain elevated.

Also helping to cap the upside on the S&P 500 index was the performance of airline stocks. These were mostly lower after United Airlines posted disappointing earnings results.

Technical Outlook for S&P 500

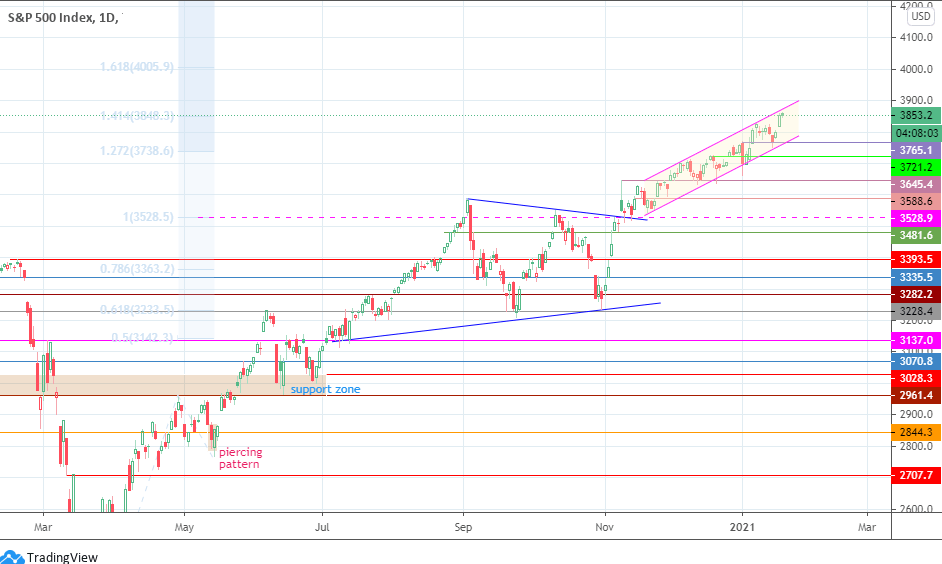

After hitting the all-time high this Thursday, sellers have come into the fray and have pushed the index mildly lower. A pullback move that targets the channel’s lower border targets the 3765.1 support. A breakdown of the channel targets the 3721.2 downside support target. 3645.4 and 3588.6 are additional downside targets of the breakdown of the channel opens the door for sellers to rush in.

On the other hand, the attainment of today’s record high represents a test of the 141.4% Fibonacci extension. S&P 500 index needs to break above the current high at 3852.8 to aim for the 161.8% Fibonacci extension level at 4005.9.

S&P 500 Index Daily Chart