- The S&P 500 index is trading higher, boosted by the Energy index, but it remains under pressure and could drop to 3645 if buying interest wanes.

The S&P 500 index is trading higher today, as a rise in crude oil prices boosted the Energy subsector stocks. The crucial senate runoff elections that will decide which party holds the majority in the US, is to hold today. The outcome could set the path for policy as the Democrat-led administration prepares to take power on January 20, barring any last minute upsets.

Today’s upside move in the S&P 500 also received a slight boost from upbeat ISM Manufacturing PMI data. A reading of 60.7 for December 2020 ensured that business conditions in the US manufacturing sector ended 2020 on a strong note, blighting the previous figure of 57.5 and the consensus number of 56.6.

Crude oil prices on the WTI benchmark are up by 4%, after reports from the OPEC + meeting indicate that an agreement may have been reached by Russia and Saudi Arabia to continue the production caps into February. The S&P 500’s Energy Index is presently up nearly 2% on the development.

Technical Levels to Watch

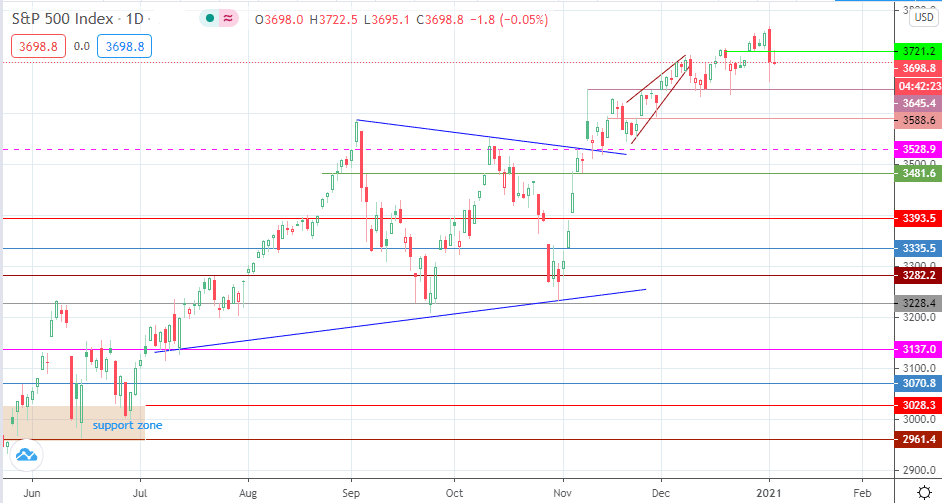

Yesterday’s slide appeared to have completed the bearish engulfing pattern. However, today’s slight recovery is tossing the possibility of a bearish outside day confirmation up in the air. However, the capping of today’s price action at the 3721.2 resistance could still allow this to happen. We would need to see a breakdown of the 3645.4 support level for the bearish evolution of this pattern to target the 3588.1 support, with 3528.9 and 3481.6 also lining up as potential downside targets.

On the flip side, the bearish expectation from the engulfing candle could be negated if bulls are able to breach 3721.2, allowing for a possible retest of Monday’s all-time highs at 3770.0. This remains the level to beat for buyers as they seek to establish new highs to kick off 2021.

S&P 500 Index; Daily Chart