- The S&P 500 index has been in a bullish trend lately. We exlain what to expext as the earnings season getd underway.

The S&P 500 index has been moving sideways recently as investors adjust to the ongoing earnings season. The index is trading at $4,662, which is slightly below its all-time high of $4,818. At the same time, the fear and greed index has crossed the neutral level of 50 and is moving to the extreme greed zone.

The earning season started last week. To a large extent, the season was relatively disappointing as companies like JP Morgan and Citigroup reported weak earnings. Citigroup is going through restructuring while JP Morgan announced huge costs.

The S&P 500 index will today to results by companies like Bank of America, Goldman Sachs, PNC Financial, Truist and Bank of New York Mellon. Later this week, other companies that will publish their results are UnitedHealth, Procter & Gamble, Prologis, Morgan Stanley, Kinder Morgan, State Street, and United Airlines. Other notable mentions this week will be Netflix, CSX, Intuitive Surgical, and Travelers.

S&P 500 forecast

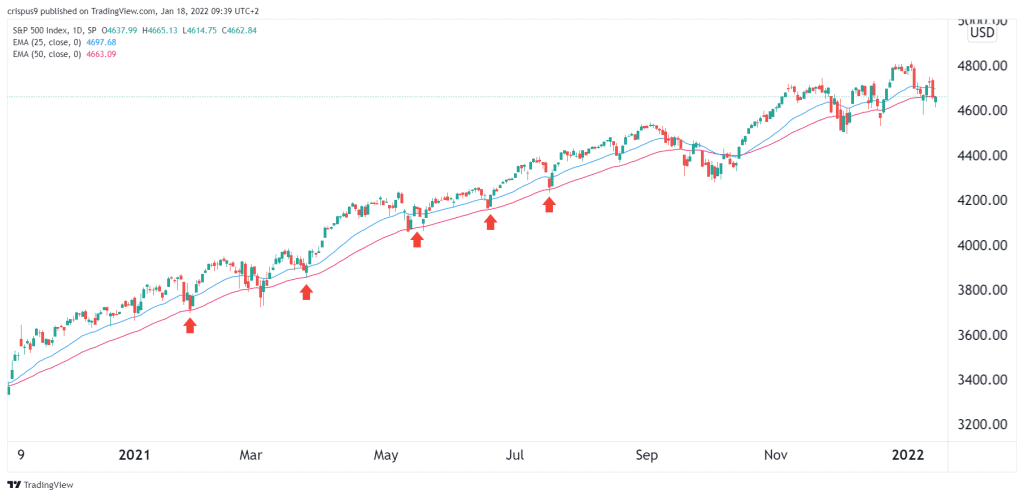

A quick look at the daily chart shows that the S&P 500 index has been in a strong bullish trend in the past few months. The chart below that the index has struggled moving below the 50-day moving averages. Now, the index has moved below both the 25-day and 50-day moving averages. The two lines of the MACD have even formed a bearish crossover.

Therefore, there is a likelihood that the SP500 index will continue moving in a downward trend in the near term as bears target the next key support at $4,500. It will then rebound as the earning season gets more underway.